Estably Blog

Market commentary: Winners of the pandemic are correcting

February 1 | Market Commentary

Pandemic-winners are fluctuating

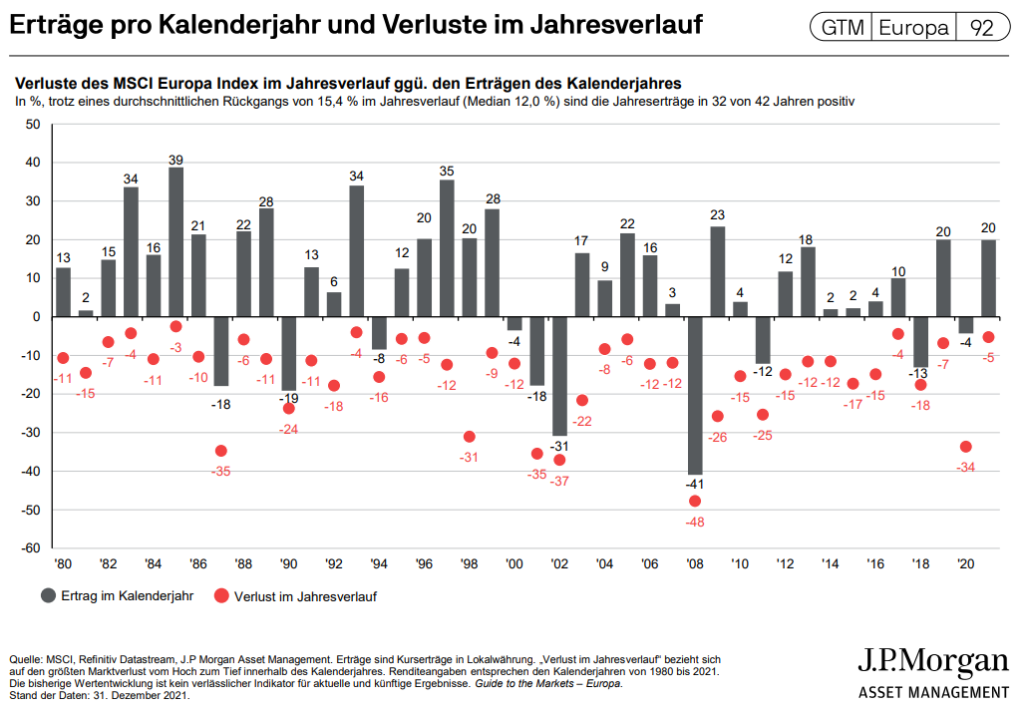

Setbacks during the year are completely normal

Rising interest rates are no threat to our technology companies

Don't try to be smarter than the masses

Conclusion

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might also like these posts

Finance Blog

Good is not good enough for us

You achieve a good return with an index – but good is not good enough for us. We want more than the MSCI World return.

The snow falls quietly, the markets crash loudly?

Is there still a year-end rally? Why we don’t care about this question, and why you shouldn’t care about it either, can be read in our little Christmas article:

The underestimated risks of ETFs and passive investing

Anyone thinking about investing money today will sooner or later come into contact with Exchange Traded Funds.