The creeping expropriation

Are Your Assets Protected From Financial Repression?

July 29, 2021 | Asset protection

We live in a world where high public debt is the norm – and not just since the Corona crisis. However, instead of relying on unpopular measures such as tax increases or cuts in social spending to reduce debt, a far more dangerous but inconspicuous method is used for savers: financial repression. As a result, the assets of conservative investors in particular suffer, as their savings in the “wrong” types of investments melt away year after year.

We explain how financial repression works and what you can do as an investor to avoid the “creeping expropriation”.

Debt reduction through artificially low interest rates

Financial repression refers to government interventions that ensure that the cheapest possible financing flows toward the state.

Until a few months ago, it was mainly the central banks that artificially pushed down interest rates so that the state could borrow “cheap” money to reduce debt. The strategy is particularly effective in combination with inflation: the devaluation of money reduces the real value of the debt, it is “inflated away”.

A prominent example of successful financial repression was provided by the USA after the Second World War. Due to the financing of the war, the national debt rose massively, but thanks to artificially low-interest rates under the Bretton Woods Agreement, the United States managed to reduce the debt burden by half (!) in the next decade.

Most investors don’t realize…

The sufferers of financial repression are conservative savers whose assets are dwindling in supposedly “safe” forms of investment with low-interest rates.

The deceptive thing is that even if the amount in your account has even increased slightly at the end of the year, you can buy less with it than a year ago due to high inflation.

Quite a few experts assume that high inflation rates are not a temporary phenomenon, but will accompany us for a longer period of time. For you as an investor, it is therefore important to act in time. The sooner you put your assets in a safe place, the more of them you will keep!

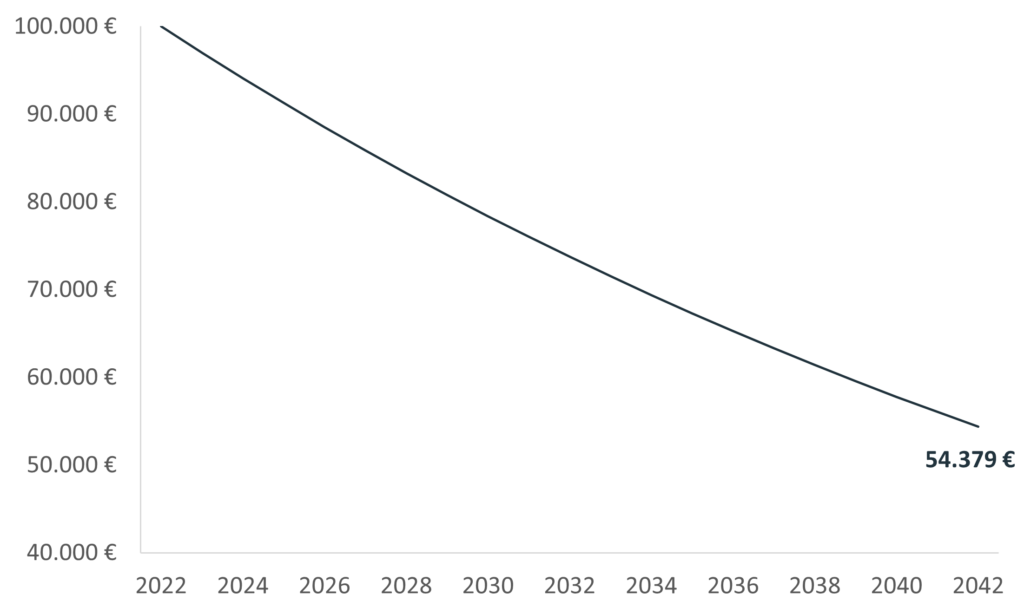

Assuming an inflation rate of 5% and an interest rate of 2%, your purchasing power will effectively shrink from an initial €100,000 to around €54,379 over the next 20 years.

In the current zero or negative interest rate environment, even the slightest inflation rate means a negative real interest rate and thus a real loss for your assets held in savings accounts, call money or time deposit accounts. The only “safe” thing about these traditional forms of investment is the fact that your money will become less over the years.

Negative real interest rates, by the way, are anything but a new phenomenon, as the German Bundesbank published back in 2014:

“In the past decades, negative real interest rates have actually been the rule rather than the exception. Even before the financial crisis, namely in the 1970s, at the beginning of the 1990s and in the 2000s, bank customers did not receive inflation-compensating interest on their savings deposits in particular. These phases of real negative interest rates even outweighed each other historically …”

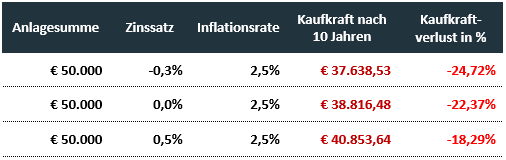

At current interest rates and inflation rates, conservative investors are already losing up to nearly 25% of their purchasing power over the next 10 years.

Outperform inflation by investing in qualitative stocks

While monetary assets (savings accounts, bonds, etc.) are at the mercy of inflation, tangible assets such as shares, real estate, or precious metals, which are based on real counter values, can even profit from rising prices.

In the case of shares, the selection of the right securities plays a decisive role, because not all companies cope equally well in phases of higher inflation. Companies with dominant market positions and unique competitive advantages offer excellent inflation protection, as they can pass on the increased costs of their more or less indispensable product directly to their consumers. As experienced value investors, we count the targeted selection of such companies among our core competencies.

For conservative investors, an investment in shares may seem risky – but those who invest for the long term and do not allow themselves to be upset by daily price fluctuations can increase their assets more strongly through participation in excellent companies than with any other form of investment.

Gold as inflation protection

The precious metal gold is the central asset of our Asset Protect Strategy. This is physically deposited for you in the vaults of the Liechtensteinische Landesbank.

In the past, gold has proven itself as a “safe haven” not only in times of crisis. Especially in times of negative real interest rates (the inflation rate is higher than the interest rate), the gold price often tends to rise sharply, while investment alternatives such as fixed-term deposits or a savings account result in a real loss of value.

Take care of your savings!

Our appeal to you: Don’t let your hard-earned money lose purchasing power in seemingly “safe” forms of investment. Invest at least part of it in tangible assets such as precious metals, real estate, or shares.

Should you decide to invest in shares, we will be happy to assist you with all our expertise!

Estably is the first digital asset management company from Liechtenstein to offer first-class wealth management from € 20,000 through a mix of technology and human investment expertise. Thanks to the portfolio managers' many years of experience in the field of value investing, above-average returns are targeted. This is intended to make professional asset management, previously available exclusively to large investors, accessible to everyone - conveniently, transparently, and profitably.

Did you like the article? Share it!

You might still like these posts

Finance Blog

Market commentary: Uncertainties lead to short-term price drops

Macroeconomic and geopolitical issues are resulting in uncertainties and leading to higher volatility on the capital markets.

Good is not good enough for us

You achieve a good return with an index – but good is not good enough for us. We want more than the MSCI World return.

The underestimated danger of financial repression

In troubled times, investors are looking for security for their assets. But what does “security” mean?