Custodian banks

We offer you a choice of three custodian banks in three different countries. Find out about the differences and advantages of each here.

Your assets in the best hands

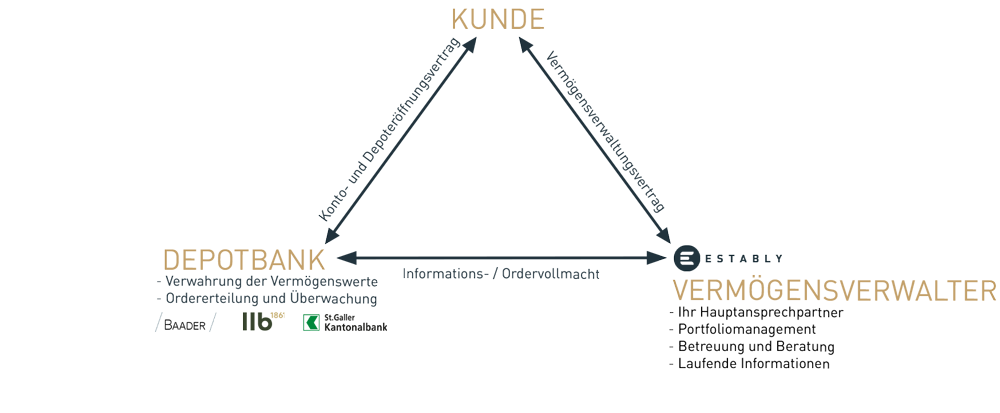

In conjunction with an asset manager, a custodian bank serves, among other things, as a depository for your assets, executes securities trading (according to the asset manager’s instructions), and handles payment transactions.

The securities in your custody account are kept separate from the rest of the bank’s assets and are also protected in the event of the bank’s insolvency. All our partner banks have state-of-the-art security standards to protect your data in the best possible way.

The interaction between client, custodian bank and asset manager:

Baader Bank

The German Baader Bank has state-of-the-art technological infrastructure and is one of the leading investment banks in Germany. For clients domiciled in Germany, Baader Bank automatically remits taxable income.

- From 20.000€ minimum investment amount

- For customers resident in Germany:

- Automatic transfer of tax revenues

- Loss offsetting pot

LLB (Liechtensteinische Landesbank)

Founded in 1861, LLB is the most traditional financial institution in the Principality of Liechtenstein. As is the case with most Liechtenstein banks, it is a major concern of the LLB to have sufficient high-quality equity capital.

Equity capital consists exclusively of hard core capital, which gives the LLB Group a high degree of financial stability and security. The equity capital of approximately CHF 1.9 billion far exceeds the legal requirements.

- From 50.000€ minimum investment amount

- Advantages of Liechtenstein as a financial center

- Traditional financial institution since 1861

St. Gallen Cantonal Bank

Founded in 1868, St. Galler Kantonalbank AG, like any other Swiss bank, is obliged to sign the self-regulatory “Agreement between esisuisse and its members”. Your deposits are therefore secured up to a maximum amount of CHF 100,000.

In addition, the bank is 51% owned by the Canton of St. Gallen. If the funds of the bank itself are not sufficient, the canton is liable for all liabilities exceeding this amount.

- From 50€ monthly

- Suitable for private pension provision

- 51% owned by the canton of St. Gallen

- Canton liable for liabilities exceeding CHF 100,000

Frequently asked questions

Custodian banks at a glance

Find out which custodian bank is suitable for your investment purpose. If you have any questions, please do not hesitate to contact us.

Deposit protection

Up to €100,000

Up to CHF 100,000

Over CHF 100,000

Minimum investment amount

From €20,000

From €50,000

From €50 per month

Strategies available

Modern Value

Value Green

Best of Funds

Modern Value

Value Green

Best of Funds

Asset Protect

Modern Value 80

(Estably as a retirement provision)

Special features

- Lower fees

- For customers resident in Germany:

- Transfer of tax revenues

- Loss offset pot

- Advantages of Liechtenstein as a financial centre

- Income statement according to applicable tax law (DE, AT, CH)

- Invest from as little as €50

- Tax advantages of old-age provision