Regulatory

Here you will find information on regulatory measures:

Estably Vermögensverwaltung AG (hereinafter referred to as the “company”) falls under the term “asset manager” pursuant to Art. 367a para. 3 of the Liechtenstein Persons and Companies Act (PGR) and must therefore describe its participation policy within the meaning of Art. 367h PGR.

The company does not exercise any shareholder rights within the meaning of Art. 367h para. 1 nos. 1 and 4 PGR that are based on participation in the companies in which the company has invested as part of asset management mandates. In particular, no rights relating to the general meetings of public limited companies are exercised. The right to a share of profits and subscription rights are exercised in consultation with the clients.

Important company matters within the meaning of Art. 367h para. 1 no. 2 PGR are monitored by taking note of the legally required reporting of the companies in financial reports and ad hoc announcements.

There is no exchange of opinions with the corporate bodies and stakeholders of the companies within the meaning of Art. 367h para. 1 no. 3 PGR.

There is no cooperation with other shareholders or other stakeholders within the meaning of Art. 367h para. 1 clauses 5 and 6 PGR.

In the event of conflicts of interest within the meaning of Art. 367h para. 1 no. 7 PGR, disclosure is made to the parties concerned in accordance with the statutory provisions and the further course of action is clarified with them.

There is no annual publication on the implementation of the participation policy within the meaning of Art. 367h para. 2 PGR because no corresponding exercise of rights takes place.

Voting behaviour within the meaning of Art. 367h para. 2 PGR is not published because there is no participation in votes.

Status: December 2022

You have decided in favour of a service from Estably Vermögensverwaltung AG. We would like to thank you for your trust.

As it is very important to us that you are satisfied with our service, please inform us immediately if you are not satisfied with our service.

Please use the following form to lodge a complaint:

Please send us this form by e-mail, fax or post:

Estably Vermögensverwaltung AG

z. Attn: Management/Compliance

P.O. Box 765

Schaanerstrasse 29

9490 Vaduz

Liechtenstein

Tel: +423 220 29 70

E-mail: [email protected]

Your complaint will be registered by our Compliance department and reported to the management. Your complaint will be examined immediately and you will receive written feedback within 20 working days.

The out-of-court arbitration centre for the financial services sector at www.schlichtungsstelle.li is also available to you as a neutral and free mediation centre for complaints.

1 General

Regulations (EU) 2019/2088 and (EU) 2020/852 require certain disclosures on the sustainability of financial market participants. With this document, Estably Vermögensverwaltung AG (ESTABLY) fulfils these disclosure requirements.

ESTABLY is a securities institution that provides asset management services for its clients. ESTABLY offers various investment strategies as part of its asset management services. Where necessary, a distinction is made between these different offers in the following explanations.

This document is made available to interested parties as pre-contractual information as part of the contract initiation process. As the contents of this document are amended from time to time, in particular to fulfil legal or other regulatory requirements, the current version is always available on the ESTABLY website.

2. Declaration on the non-consideration of adverse effects on sustainability factors

Investment decisions can have a negative impact on the environment (e.g. climate, water, biodiversity), on social and labour issues and can also be detrimental to the fight against corruption and bribery. ESTABLY endeavours to fulfil its responsibility as an investment firm and to contribute to avoiding such adverse effects at company level.

As the relevant regulatory requirements (the subject of which is, inter alia, this mandatory disclosure) have not yet been fully published at the time of writing, ESTABLY is not yet able to make a binding statement to the effect that (and in what way) adverse impacts of investment decisions on sustainability factors are taken into account.

ESTABLY therefore declares that it will not bindingly consider adverse effects of investment decisions on sustainability factors until further notice. As soon as the corresponding regulatory requirements are published in full, ESTABLY will review these requirements and reassess and, if necessary, adjust its position with regard to adverse effects of investment decisions on sustainability factors.

3. Consideration of sustainability risks

As a company, we want to contribute to a more sustainable, resource-efficient economy with the aim of reducing the risks and effects of climate change in particular.

In our investment process, we consider E (environmental), S (social) and G (governance) criteria (ESG criteria). Sustainability risks resulting from the analysis of the ESG criteria are continuously analysed with regard to their financial impact and the resulting findings on the sustainability risks of individual issuers are taken into account as part of the investment process when evaluating the risk and return assessment. Sustainability risks are events or conditions in the areas of environmental, social and governance (ESG), the occurrence of which could have an actual or potential material negative impact on the value of the investments. Sustainability risks can have an impact on all known risk types and contribute as a factor to the materiality of these risk types. The impact, probability and severity of sustainability risks vary depending on the sector, business model and sustainability strategy of the issuer.

Furthermore, the company’s employees regularly receive comprehensive training and further education on the topic of sustainability.

Sustainability risks can have a negative impact on the return of the investment strategy during the investment process. In particular, they can lead to a significant deterioration in the financial situation, profitability or reputation of the issuer and have a significant impact on the valuation level of the investment. The investment strategies offered by ESTABLY do not take into account the EU criteria for environmentally sustainable economic activities.

How sustainability risks are taken into account

ESTABLY takes sustainability risks into account in the investment process.

However, there is neither an application of environmental or social characteristics nor an endeavour to comply with sustainability objectives within the meaning of Regulation (EU) 2019/2088 and the EU criteria for environmentally sustainable economic activities, nor a minimum proportion of such investments.

Sustainability risks are analysed on the basis of publicly available information from issuers (e.g. annual and sustainability reports) or internal research and using data and ESG ratings from research and rating agencies.

MSCI calculates ESG ratings, which assess the extent to which companies take into account the aforementioned sustainability indicators in the areas of environment, social affairs and corporate governance. These ESG ratings are used by ESTABLY to take sustainability risks into account. To prevent greenwashing, the external MSCI ESG ratings are used to take sustainability risks into account.

Do these investment strategies take into account material adverse impacts on sustainability factors?

No, these investment strategies do not currently consider material adverse impacts on sustainability risks.

Methods for measuring the promotion of environmental and social characteristics

In ESTABLY’s investment universe, companies are selected according to a variety of quantitative and qualitative criteria. Companies that produce landmines, cluster munitions and nuclear weapons or that violate the United Nations Global Compact are excluded.

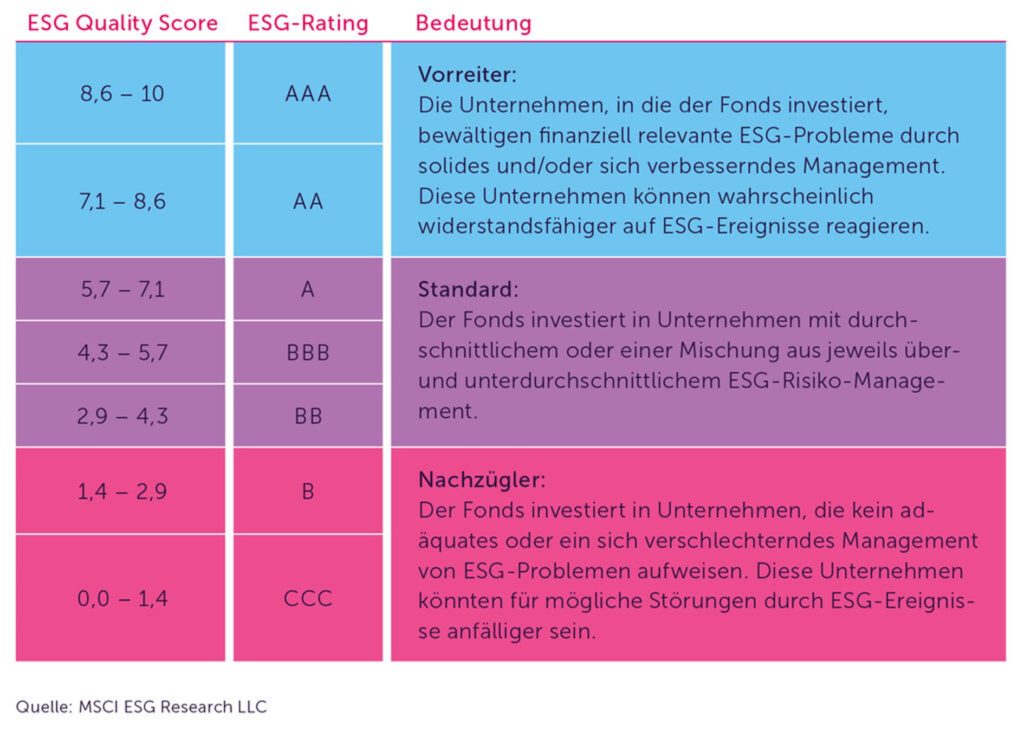

ESTABLY also evaluates the investments based on their ESG score. The approach used to calculate the ESG Quality Score is a rule-based methodology to measure the resilience of companies to long-term environmental, social and governance risks. Companies are rated on a scale from “AAA” to “CCC”, depending on the ESG risks relevant to the industry and the ability of companies to manage these risks in comparison to their competitors. The higher the ESG Quality Score, the better for the environment.

Data sources and data processing

ESTABLY uses one of the world’s leading providers of sustainability data: MSCI ESG Research. This data enables us to integrate our responsible approach into the selection of investments. This involves analysing publicly available company documents and data from alternative sources, including governments, authorities and non-governmental organisations. Furthermore, MSCI ESG Research LLC accesses over 3,400 media for data procurement. These ratings are critically reviewed for plausibility by the Investment Committee, which meets regularly.

Due diligence

ESTABLY obtains ESG ratings from the provider MSCI.

Reference benchmark

ESTABLY has not defined its own benchmark with dedicated environmental or social characteristics.

Sustainable investment strategy

In its Value Green strategy, ESTABLY considers companies that meet certain ESG standards.

How sustainability risks are incorporated

The “Value Green” strategy therefore promotes sustainability in the environmental, social and governance areas, but does not aim for a sustainability target within the meaning of Regulation (EU) 2019/2088 and the EU criteria for environmentally sustainable economic activities or a minimum proportion of such investments.

Which environmental and/or social characteristics are promoted by the investment strategy?

In addition to the selection criteria in the non-sustainable investment strategies, the three aspects of sustainability (environmental, social and corporate governance) are taken into account when selecting companies. ESTABLY primarily selects companies from the investment universe on which the classic ESTABLY strategies are based whose composition takes certain ESG standards into account.

As a rule, the following indicators, among others, can be taken into account:

Environment

Exclusion of companies whose main source of income is the production of energy from coal; and

Exclusion of companies involved in the extraction of oil from oil sands or the mining of oil sands.

Social

Exclusion of companies whose main source of income is the sale or distribution of tobacco products; and

Exclusion of companies involved in business with civilian and socially controversial weapons or nuclear weapons; and

Compliance with high occupational health and safety standards.

Corporate governance

- Compliance with the principles (including compliance with human rights) of the United Nations Global Compact; and

- Consideration of violations of competition rules and corruption laws.

Controversial business areas are analysed by MSCI, which assesses the extent to which the companies take the aforementioned indicators into account.

This rating is used by ESTABLY when selecting companies for the Value Green strategy.

Transparency of the remuneration policy in connection with the consideration of sustainability risks

Our company’s strategies for incorporating sustainability risks are also incorporated into the company’s internal organisational guidelines. Compliance with these guidelines is decisive for the evaluation of our employees’ work performance and therefore has a significant influence on future salary development. In this respect, the remuneration policy is in line with our strategies for incorporating sustainability risks.

Status: February 2023