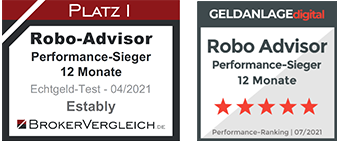

From €50 per month

Build up assets in a tax-optimised way

Save our dynamic Modern Value 80 portfolio as part of your private pension provision from as little as €50 per month and benefit from unique tax advantages!

- Higher return thanks to tax advantages

- Location advantages with insurance in Liechtenstein

- Free policy check for existing pension provision

The smart way to prosperity

Even a small monthly amount can create a large fortune in the long term. The unique tax advantages that our retirement savings solution brings maximise your return.

Low entry amount

Even a small monthly amount can create a large fortune in the long term - with us you can start from as little as €50 per month.

Unique tax advantages

Thanks to special taxation rules in the context of old-age provisions, you are left with more returns in the end.

Strong compound interest effect

The compound interest effect makes your assets grow exponentially in the long term.

Transparent & fare costs

As a digital provider, we can offer our service more cheaply. It is important for us to communicate our costs in a completely transparent way.

Flexible payout options

You decide whether you want the money paid out in one go or monthly.

Digital overview

With our app, you can make co-payments, receive documents digitally & securely, and always keep an eye on performance.

Provide for winners with the real money test

biallo.de

Performance winner 2023

geldanlage-digital.de

Performance winner 12 months (02/2024)

brokervergleich.de

Performance winner 2023

brokervergleich.de

Best risk-return ratio 2023

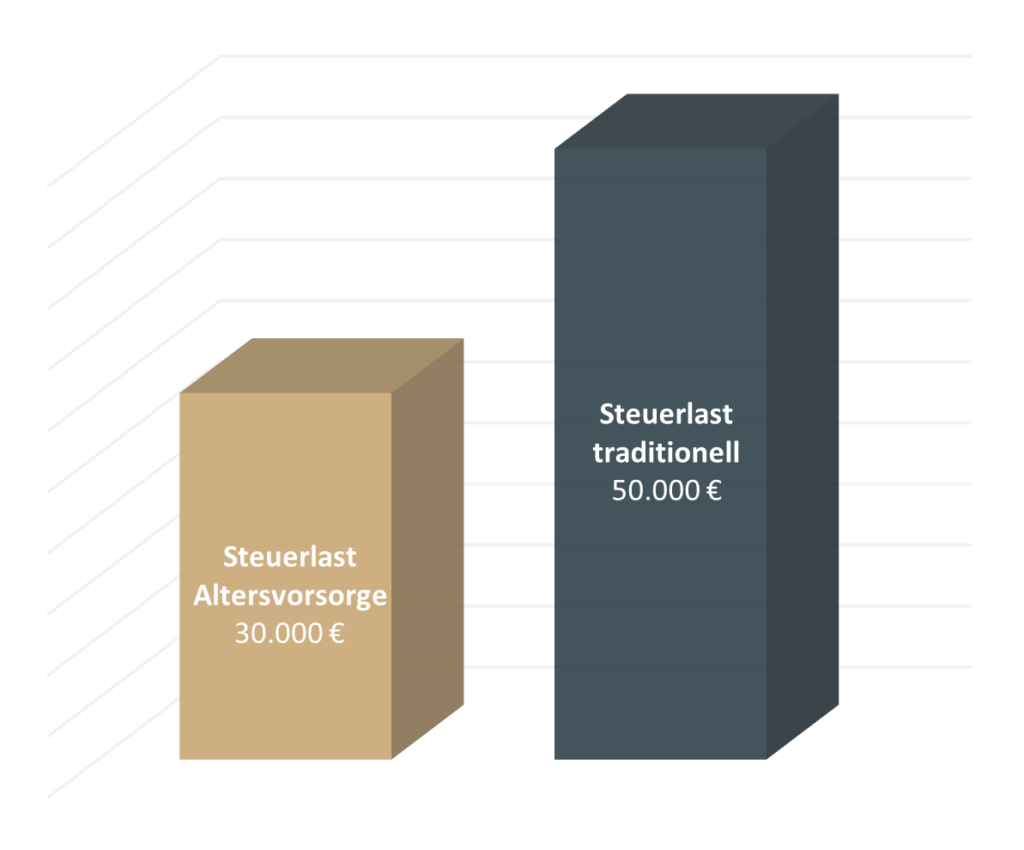

Maximum return with minimum tax burden

Find out how much you can save through tax benefits!

Your tax advantages with a pension plan:

Tax-free savings phase

During the savings phase, you do not pay any taxes on the profits of your investments. Your savings amount is therefore larger and you profit even more from the interest effect in the end!

Only half of the profit taxed

If your pension plan has been active for at least 12 years and you have reached the age of 62, only half of your gain is taxed.

Example: Tax saving

With a personal tax rate of 30%, you effectively pay only 15% tax on the gains (instead of 25% capital gains tax). With an increase in value of €200,000, this amounts to a saving of €20,000.

Decisive advantages of Liechtenstein insurance

The Principality of Liechtenstein not only boasts a stable political and legal framework, but also has important advantages over insurance in Germany.

No payment ban

If an insurance company gets into difficulties in Germany, a "payment ban" can be imposed by law. The insurance company must then temporarily stop making payments. This law does not exist in Liechtenstein.

Triple-A rating without sovereign debt

Liechtenstein is one of the few debt-free states in the world. Thanks to a combination of direct democracy and constitutional hereditary monarchy, Liechtenstein also enjoys an extraordinarily solid social, legal and economic order.

Value investing: the proven investment strategy

Your assets are invested by us according to modern value investing principles in shares of first-class companies that we classify as undervalued.

Strong long-term performance

Equities have proven in the past that they perform better than all other asset classes over a correspondingly long period of time.

Risk diversification through bonds

A mixed bond component (max. 20%) ensures diversification and stability in your portfolio.

Security of Switzerland as a financial centre

Your assets are held in your own custody account at the St. Galler Kantonalbank.

Warren Buffett, Value Investor

Thanks to tax advantages, more of the profit remains

Within old-age provision, tax advantages make your investment even more profitable.

Tax-free savings phase

During the savings phase, you do not pay any taxes on the profits of your investments. The savings amount thus becomes larger and you benefit even more from the compound interest effect in the end!

Only half of the profit taxed

If your pension scheme has been active for at least 12 years and you have reached the age of 62, only half of the gain is taxed.

Example: With a personal tax rate of 30%, the gains effectively attract 15% tax instead of 25% capital gains tax. With an increase in value of 200,000€, this amounts to a saving of 20,000€.

We will be happy to provide you with more details about your tax benefits in a personal meeting.

Our costs: transparent & fair

Complete transparency is important to us. In this table we show you the advantages you have with our savings plan variant.

Estably as Asset Management

Estably as a Retirement Provision

Minimum investment amount

From €20,000 one-off payment

From €50 per month

All-In Fee

(depending on the amount of the monthly payments or the premium)

From 1.2% p.a.

Deposits under €100 per month:

2.10% p.a.

Deposits over €100 per month:

1.50% p.a.

Monthly fixed fee

For less than 10.000€ invested bonus: 5€ monthly.

Note: This amount will be invested and paid out to you again at the end of the term (= loyalty bonus).

Loyalty bonus

Performance Fee

10%¹

10%¹

Tax-free savings phase

Taxation on payout

Capital gains tax

Income tax only on half of the income²

Death benefit

110% of fixed assets³

No entry or termination fees

Life annuity option

¹ The performance fee of 10% only applies if Estably reaches a new performance peak in the respective year. If Estably does not achieve this, any decline must be recovered in the following year before this fee is incurred. Details

² For this so-called half-income procedure to apply, you must remain invested for at least 12 years and until you reach the age of 62. Before that, capital gains tax applies.

³ The death benefit decreases from 110% of the investment assets to 100% of the investment assets on a straight-line basis until the start of annuitisation. An individual premium is calculated for this. For a healthy 30-year-old, experience shows that this is less than €1 per year.

Our costs: transparent & fair

Complete transparency is important to us. This table tells you everything you need to know about our fees:

Estably as a Retirement provision

Minimum investment amount:

From €50 per month

All-In Fee:

under 100€ monthly: 2,10%

over 100€ monthly: 1.50%

From 10.000€ invested premiums: 1,50%

Fixed fee:

For less than 10.000€ invested premiums: 5€ monthly. However, this amount is invested and paid out again at the end of the term (= loyalty bonus).

Loyalty bonus:

Yes

Performance Fee:

10%¹

Taxation on payout:

Income tax on half of the income²

Death benefit:

110% of the asset³

Entry/termination fees:

No

Life annuity option:

Yes

¹ The performance fee of 10% only applies if Estably reaches a new performance peak in the respective year. If Estably does not achieve this, any decline must be recovered in the following year before this fee is incurred. Details

² For this so-called half-income procedure to apply, you must remain invested for at least 12 years and until you reach the age of 62. Before that, capital gains tax applies.

³ The death benefit decreases from 110% of the investment assets to 100% of the investment assets on a straight-line basis until the start of annuitisation. An individual premium is calculated for this. For a healthy 30-year-old, experience shows that this is less than €1 per year.

Let your assets grow exponentially

The earlier you start saving, the more you benefit from the compound interest effect.

Here you can see an example of the performance of a pension insurance policy. In this example, the insured person is 40 years old and invests €100 per month for 27 years.

Development of assets for a monthly deposit of €100 with an assumed net performance of 8%.

FAQs

Frequently asked questions

Digital & uncomplicated to prosperity in old age

We guide you step by step to your goal.

Step 1

Fill out form on this page

Step 2

Follow the email invitation

Step 3

Perform onboarding

Step 4

Perform identity verification in the app

Step 5

Sign contract digitally

Digital & uncomplicated to prosperity in old age

This is how private pension provision works:

1. Start the onboarding process

Here start the registration process, which will take you step by step to your destination.

2. monthly deposits

during the term

We offer flexible deposit options. An initial investment is also possible in addition to the monthly deposits.

3. Have tax-optimised assets

paid out

At the end of the term (after at least 12 years and from the age of 62), you can have your assets paid out flexibly.

Do you already have an existing pension plan?

Our experts offer you an objective analysis free of charge so that you can compare your existing policy with the pension solution from Estably and prosperity solutions.

Learn all about the

tax-optimised prosperity provision

In a non-binding discussion, we will inform you about how you can make tax-optimized provisions for your prosperity.

Do you have no further questions? Go directly here!

Start your retirement provision with Estably and prosperity solutions

Start your tax-optimized old-age provision in a few minutes, uncomplicated and completely digitally.

(Note: there is no charge for registration)

The insurance policy is brokered by prosperity solutions AG, an insurance agent of the Liechtenstein Life Assurance AG

prosperity solutions AG operates as an insurance agent within the meaning of the Insurance Distribution Act of 5 December 2017 (VersVertG, LGBl. 2018 No. 9).

The insurance policy is brokered by prosperity solutions AG, an insurance agent of the Liechtenstein Life Assurance AG

Prosperity solutions AG operates as an insurance agent within the meaning of the Insurance Distribution Act of 5 December 2017 (VersVertG, LGBl. 2018 No. 9).