Best of Funds Strategy

Investing money like the star investors

In the “Best of Funds” strategy, we invest your assets broadly diversified in the most successful value & quality funds.

- Investments in Value & Quality Investing Funds

- Actively managed bond funds as an admixture

- Handpicked individual stocks

- 5 individual risk preferences

Best of Funds Strategy

Investing money like the star investors

In the “Best of Funds” strategy, we invest your assets broadly diversified in the most successful value & quality funds.

- Investment in Value & Quality Investing Funds

- Handpicked individual shares and

- actively managed bond funds for admixture

- (Note: This strategy is only available to investors who are resident in Germany for tax purposes).

20.000€ / 50.000€

Minimum investment

(depending on custodian bank)

0,99% / 1,19%

Service fee

(depending on the custodian bank)

0,5% - 0,8% p.a.

Product costs

10%

Performance Fee

(High Water Mark Principle)

Exclusive Investments

Your access to the most successful value & quality investing funds

In the “Best of Funds” strategy, we invest for you in the funds of the most successful value and quality investors and hand-picked individual shares with a focus on holding companies.

Due to high minimum investment sums and expensive initial charges, these exclusive investments are normally associated with considerable additional costs for private individuals. As an institutional investor, however, we give you access to the significantly more cost-effective institutional tranches. We buy all funds without a front-end load.

Risk diversification

Lower fluctuations thanks to broad diversification

You determine your growth opportunities

Within the Best of Funds strategy, you can choose from five portfolios, which differ in their respective equity or bond share. A higher share of equities generally means more long-term growth potential with higher fluctuations in value.

Conservative

Best of

Funds 20

Long-term preservation of real assets with small fluctuations

Defensive

Best of

Funds 40

Long-term asset growth with moderate fluctuations

Balanced

Best of

Funds 60

Greater growth in the long term with medium fluctuations

Dynamic

Best of

Funds 80

Significant growth in the long term with major fluctuations

Offensive

Best of

Funds 100

Strong long-term growth with major fluctuations

Can’t make up your mind?

During our application process, we will suggest a suitable portfolio based on your knowledge and risk appetite.

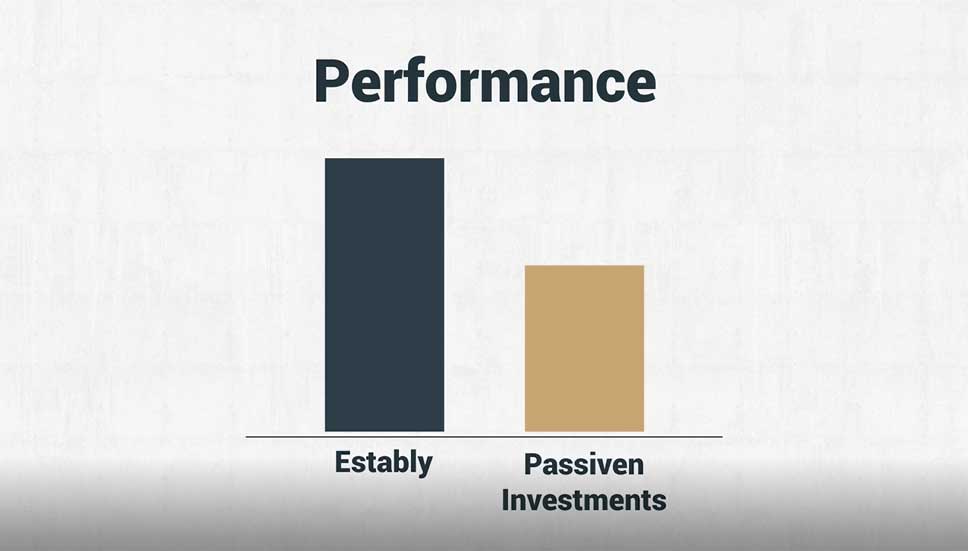

Return

Performance of the Best of Funds portfolios since inception

Our fees: Transparent & fair

The costs for the Best of Funds strategy consist of a service fee, product costs (for the funds used) and a performance fee. However, this is only incurred if we have been able to achieve a new performance high in your custody account.

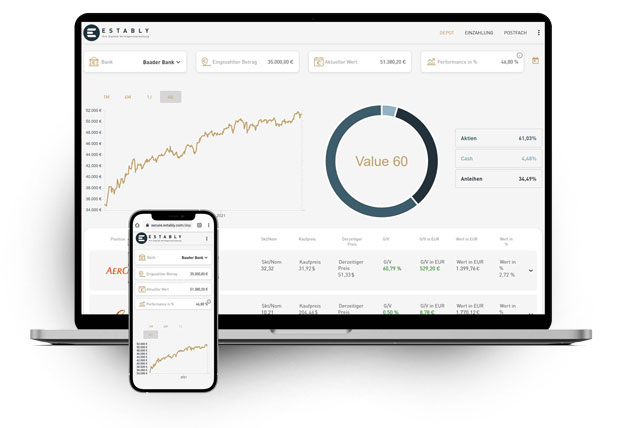

Your costs depend on the custodian bank you choose:

About Baader Bank

The German Baader Bank has state-of-the-art technological infrastructure and is one of the leading investment banks in Germany. For clients domiciled in Germany, Baader Bank automatically remits taxable income.

- From €20,000 minimum investment amount

- For customers resident in Germany:

- Automatic transfer of tax revenues

- Loss offsetting pot

About the LLB

About the LLB

Founded in 1861, LLB is the most traditional financial institution in the Principality of Liechtenstein. Like most Liechtenstein banks, LLB is very concerned to have sufficient high-quality equity capital.

- From €50,000 minimum investment amount

- Advantages of Liechtenstein as a financial centre (learn more)

- Traditional financial institution since 1861

1.19% service charges

0,33% Bank charges

0,50-0,80% Product costs

Awards

Invest in the winner of real money performance tests

biallo.de

Performance winner 2023

geldanlage-digital.de

Performance winner 12 months (02/2024)

brokervergleich.de

Performance winner 2023

brokervergleich.de

Best risk-return ratio 2023

At a glance

Best of Funds Strategy

- Investments in selected funds and individual shares

- Supplemented by bond funds

- Tax advantages through partial exemption

- Own securities account at Baader Bank or Liechtensteinische Landesbank

- Access to your personal dashboard

- Only for investors with tax residence in Germany

Our strategies

Individual shares

Our “Modern Value” strategy is based on hand-picked individual stocks that are selected according to modern value investing principles.

Funds

The “Best of Funds” strategy enables you to invest in the funds of the most successful value and quality investors.

Gold

This strategy focuses on protecting your assets. To this end, we invest in gold, supplemented by stable currencies.