Costs

As a customer, you should always know what you are paying and for what.

Here you will find all the information about our fees at a glance.

Modern Value

Baader

LLB

All-In Fee

Service Fee

Product Costs

Custody fees

Trans. fees

Perf. fee

1,2% p.a.

–

–

–

–

10%

1,5% p.a.

–

–

–

–

10%

Value Green

Baader

LLB

All-In Fee

Service Fee

Product Costs

Custody fees

Trans. fees

Perf. fee

1,2% p.a.

–

–

–

–

10%

1,5% p.a.

–

–

–

–

10%

Best of Funds

Baader

LLB

All-In Fee

Service Fee

Product Costs

Custody fees

Trans. fees

Perf. fee

–

0,99% p.a.

∼0,65% p.a.

–

–

10%

–

1,19% p.a.

∼0,65% p.a.

–

–

10%

Asset Protect

LLB

All-In Fee

Service Fee

Product Costs

Bank charges

Perf. fee

1,19% p.a.

–

–

–

–

Select custodian bank:

Costs (from €20,000 investment amount)

Modern Value

Value Green

Best of Funds

Asset Protect

All-In Fee

1,20% p.a.

1,20% p.a.

–

1,19% p.a.

Service fee

–

–

0,99% p.a.

–

Product costs

The level of the product costs depends on

the selected risk class and can

can range from 0.5% p.a. (Best of Funds 20)

to 0.8% p.a. (Best of Funds 100).

–

–

~0,65% p.a.

–

Performance Fee

10%

10%

10%

–

Costs (from €50,000 investment amount)

Modern Value

Value Green

Best of Funds

Asset Protect

All-In Fee

1,50% p.a.

1,50% p.a.

–

1,19% p.a.

Service fee

–

–

1,19% p.a.

–

Product costs

The level of the product costs depends on

the selected risk class and can

can range from 0.5% p.a. (Best of Funds 20)

to 0.8% p.a. (Best of Funds 100).

–

–

~0,65% p.a.

–

Performance Fee

10%

10%

10%

–

Lower costs and even more custodians?

For larger investment sums, there are further investment options available to you

"All-In" Cost model

Our costs are all-in: this means that all fees (for account and custody account management, securities transactions and asset management fees) are included. Only in the case of our “Best of Funds” strategy are product costs for the funds used added.

Service fee

+

Custody fee

+

Bank charges

+

Transaction costs

=

All-In Fee

If we reach a new performance peak within a year, a performance fee of 10% is added to the gains (according to the high-water mark principle, you can find out more about this here).

Custodians

Choose Baader Bank, based in Germany, or Liechtensteinische Landesbank (LLB), with the unique advantages of Liechtenstein as a financial center, as your custodian bank.

For a private pension plan with Estably and Prosperity, your custody account will be opened at St. Galler Kantonalbank in Switzerland.

About Baader Bank

The German Baader Bank has a state-of-the-art technological infrastructure and is one of the leading investment banks in Germany.

Deposit guarantee:

Up to €100,000

Minimum investment amount:

20.000 €

About the LLB

Founded in 1861, the LLB boasts an above-average equity ratio and has the Principality of Liechtenstein as its main shareholder.

Deposit guarantee:

Up to CHF 100,000

Minimum investment amount:

50.000 €

About the St. Galler Kantonalbank

The regionally rooted universal bank has been advising and serving private and business customers on all aspects of money for over 150 years.

Deposit insurance:

Up to CHF 100,000

Minimum investment amount:

50 € per month via the Estably Retirement Plan

You do not have the minimum investment amount?

Thanks to our cooperation with prosperity solutions AG, you can save our portfolios for your private old-age provision from as little as €50 per month and still save on taxes!

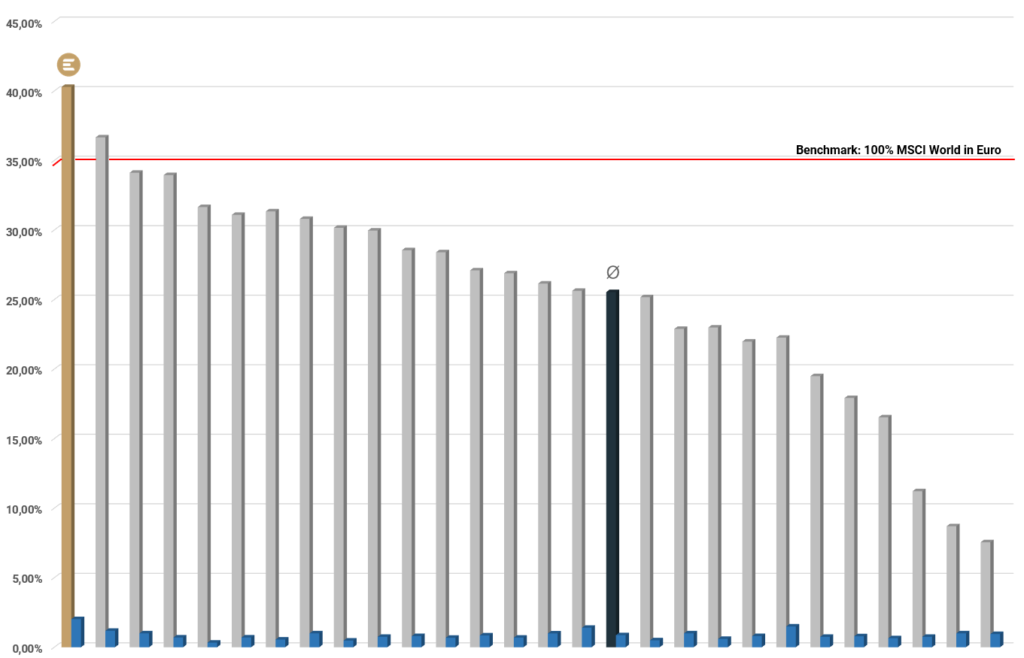

Bottom line: more performance.

How do we perform after deducting all costs?

The following chart shows the return of our Value 100 strategy after the deduction of all costs (all-in fee + performance fee) compared to the offensive strategies of other providers on the German market:

12-month performance of the robo-advisors on the German market after deduction of costs: The blue bars represent the total costs already deducted (composed of service fees, fund costs, and performance fees). The offensive strategies of all providers were used for comparison. Data source: biallo.de. Performance date: 31 July 2021

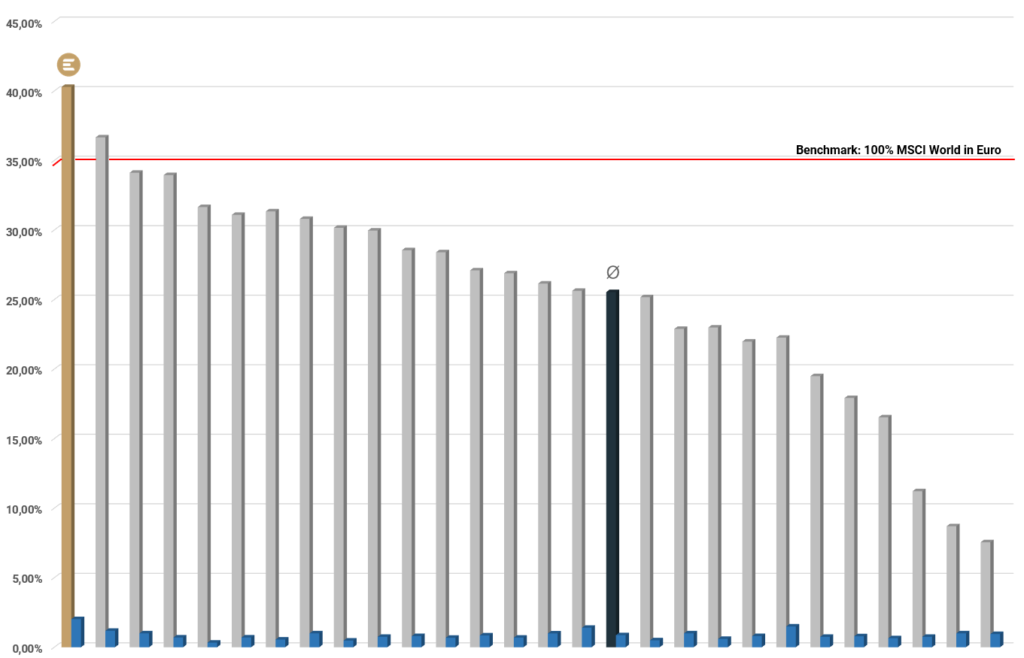

Bottom line: more performance.

How do we perform after deducting all costs in a performance comparison?

The following chart shows the return of our Value 100 strategy after deduction of all costs (all-in fee + performance fee) compared to the offensive strategies of other providers on the German market:

12-months-performance of Robo-advisors on the German market after deduction of costs: The blue bars represent the total costs already deducted (composed of service fees, product costs, and performance fees). The offensive strategies of all providers were used for comparison. Data source: biallo.de. Performance date: July 31, 2021

Performance Fee (High-Water-Mark)

The High Water Mark ensures that we only charge a fee if we take your assets to a new high. You can find more information on this in our High Water Mark explanation video.