High-Performance Strategies in the Safest Financial Center in Europe

As a digital asset manager in the Principality of Liechtenstein, we invest in outstanding companies in order to increase your assets in the long term.

Focus on performance

- Modern Value Investing Strategy

- Individual shares instead of ETFs

- Most stable framework conditions for investors

- High security through financial market supervision

Personalised service

- Advisor at your side

- By telephone, in writing or in person

Known from

Known from

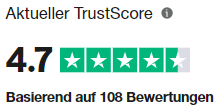

Digital Asset Management

First-Class Investment Made Easy

With a combination of digital convenience and human investment expertise, our aim is to increase your assets in the long term. With a custody account in the renowned financial centre of Liechtenstein, we not only offer optimal framework conditions, but also a high degree of asset protection.

Excellent performance

Our investment strategies aim to achieve above-average returns over the long term.

Moderne Value Investing

Your assets are invested according to the same principles that Warren Buffett, among others, relies on.

Security in Liechtenstein

Liechtenstein is one of the most sought-after financial centres in the world thanks to its ideal framework conditions.

Comfort thanks to technology

You can open a custody account and monitor your portfolio on the device of your choice.

Customised portfolios

Conservative, balanced or offensive? We offer a suitable strategy for every type of investor.

Personalised service

If you have any questions about your portfolio or our strategy, a personal advisor is available to you at any time.

Investing for strong performance

Top Returns With High-Quality Shares

Are you looking for an investment opportunity that will enable you to achieve above-average performance over the long term? With our equity-based strategies, we strive for higher returns than passive investments such as ETFs.

Hand-picked shares

Your assets are invested in shares of outstanding companies.

Modern Value Investing

We rely on the same strategy that makes Warren Buffett, among others, so successful.

Fair fee structure

Your costs consist of an all-in fee and a performance fee.

+103.55% since 2016

The longer the investment period, the higher your chances of

Individual portfolios

You determine the growth opportunities for your assets.

Diversification through bonds

A bond component in your portfolio ensures diversification and risk spreading.

Our investment philosophy

Modern Value Investing

We invest your assets according to modern value investing principles. We make long-term investments in outstanding companies that are trading below their value on the stock market.

The price is what you pay for.

The value, what you get.- Warren Buffett, Value Investor

Months of analyses

Before a company ends up in your portfolio, we spend months analysing it down to the smallest detail. In this way, we increase your long-term return opportunities and reduce the risk.

Low price, high value

To give you the chance of high returns in the long term, we invest exclusively in undervalued companies.

Equities as inflation protection

Thanks to their leading market positions, many companies in our portfolios are in a position to pass on rising inflation rates directly to end consumers.

You stay informed

You will receive regular updates on our investments to keep you informed about our approach.

Estably yielded the best performance of all Robo-Advisors and was able to beat both benchmarks.

Principality of Liechtenstein

Security in Europe's Most Sought-After Financial Centre

The Principality of Liechtenstein is no longer the tax haven of decades past. Today, the location boasts numerous advantages that attract capital investors from all over the world.

- High equity ratios of the banks

- AAA rating without sovereign debt

- EEA benefits without EU membership

- Security thanks to strong regulation

- Economic area with Switzerland

- Stable Swiss franc as a currency

Andreas

Great performance + super service

I had Estably on my radar for a while (from the real money tests) and wanted to wait a little longer, but perhaps I should have invested a little earlier because the performance is simply great!

And as has already been written here, the service is really great, the advisors take enough time for you.

Tamara B.

Friendly customer service

I feel that I am in good hands with Estaby, the search for a partner to manage my assets required a lot of comparative work. The personal contact was always friendly and appreciative, which is something you don’t find everywhere. I am satisfied.

Please keep up the good work!

Klaus

Absolutely recommendable!

Everything is explained very clearly on the website, and I spoke to an advisor briefly before finalising the contract just to make sure I understood everything correctly.

Great combination of digital and “personal”. Absolutely recommendable!

FAQ

Frequently Asked Questions

A digital asset manager endeavours to protect and grow its clients’ assets in the long term by actively trading on the markets.

Similar to banks, asset managers are subject to legal supervision and require a licence to offer their services.

The integration of modern technology offers an excellent opportunity for uncomplicated, high-quality investment.

Digital asset management:

We manage and grow your assets over the long term using an investment strategy of your choice.

Trade yourself:

We arrange a first-class custody account for you with the renowned provider Interactive Brokers and are at your side with customised training, individual support, a wide range of products and attractive conditions.

Private pension provision:

In co-operation with insurance companies, we enable you to make provision for your retirement. The insurance cover allows you to benefit from tax advantages, among other things.

Overnight and fixed-term deposits:

With our attractive range of overnight and fixed-term deposits, we offer you shorter-term opportunities to invest your assets in one of the safest locations in the world.

While traditional robo-advisors usually invest passively in ETFs or funds, we endeavor to achieve above-average returns with our “Modern Value” and “Value Green” strategies by carefully selecting individual shares. We are the only provider to rely on a modern form of value investing, which investment legend Warren Buffett, among others, swears by.

As a digital asset manager in Liechtenstein, you also benefit from the excellent framework conditions of one of the most sought-after financial Centers in the world.

Depending on your investment strategy, we invest your assets in the following asset classes:

Modern Value: individual shares and bond funds

Value Green: Sustainable single stocks and bond ETFs

Best of Funds: Equity and bond funds and a few individual equities

Asset Protect: Physical gold and foreign currencies

Thanks to its unique political and legal framework, the Principality offers an extraordinarily high level of security and stability.

Liechtenstein is also one of only very few debt-free AAA states in the world.

You can find out more about the unique circumstances in the dwarf state here.

Yes, you can access your assets or close your custody account at any time – there is no cancellation period.

However, due to our long-term investment strategy, we recommend that you plan an investment period of at least 5 years.

Your assets are held in safekeeping by our custodian banks (Baader Bank or Liechtensteinische Landesbank).

Both banks are affiliated to deposit protection schemes, which means that the securities in your custody account are kept completely separate from the rest of the bank’s assets and are not affected in the event of the bank’s insolvency.

Your account balance is protected in the event of insolvency up to an amount of EUR 100,000 or CHF 100,000.

How to Open Your Estably Custody Account:

1. Your investment preferences

The first step is to answer questions about your investment preferences so that we can suggest a suitable strategy.

2. Get investment proposal

You then have the choice of either choosing the strategy we suggest or deciding for yourself.

3. Grow assets in the long term

Once you have transferred the investment amount, we invest your assets in the desired strategy.

Free consultation

Enter the world of digital investments

With Estably, you have a wide range of opportunities to invest your assets profitably in a unique environment.

Book a non-binding consultation now and we will be happy to advise you! Let’s find out together whether our strategies match your investment preferences.