The underestimated danger of financial repression

January 17, 2019 | Digital Asset Management

In troubled times, investors are looking for security for their assets. But what does “security” mean? In a world that is heavily indebted, where geopolitical tensions are increasing, and where industrial production is being digitized, investors should question which investments they believe to be safe offer real protection and added value.

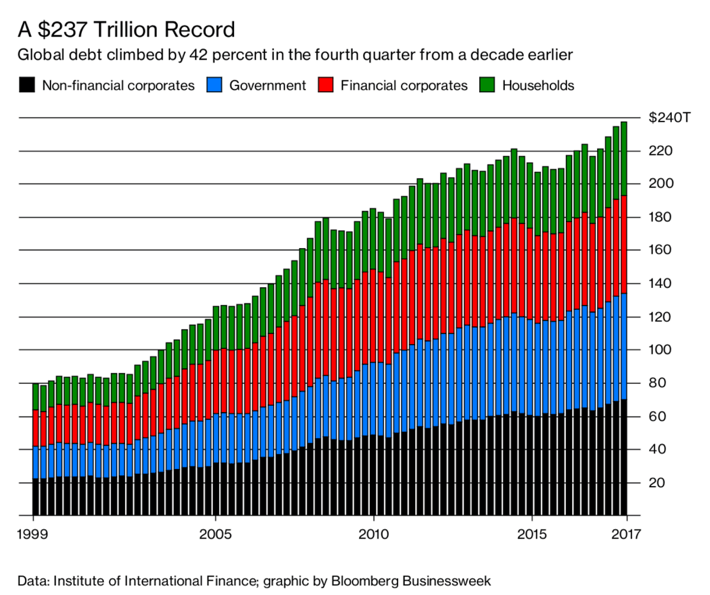

The global credit burden now amounts to USD 234 trillion (as of October 2018).

In just 20 years, the world’s debt tripled. If 10,000 EUR were unaffected on your account in the same period, you can only buy 50-60% today compared to then. Because the products became more expensive – the money thus less value. Inflation has struck. In the example approx. 3% per year.

Inflation is the quietest tool for states to reduce their debt. In addition, there are alternatives such as national bankruptcy, expropriation or special taxes. Unless a state manages to save money. That would be the most sensible course of action, but certainly not a way to win the next elections. A creeping tool that is hardly noticed by the general public is financial repression. This occurs when real interest rates are negative. If, for example, you receive 3% interest on your money while inflation is 5%, the real interest rate is -2%.

This causes a redistribution from saver to debtor, expropriates owners of financial assets and helps to relieve the state of its debt. Nowadays, investors must protect themselves from financial repression.

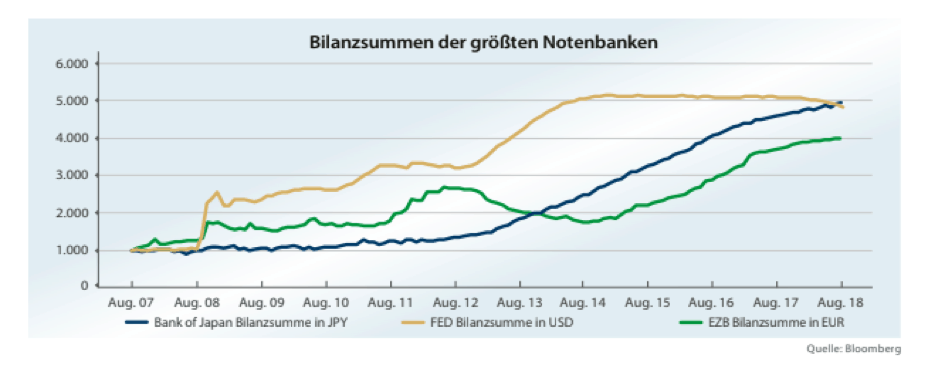

The following chart shows how much the central banks have expanded their balance sheets and kept interest rates artificially low.

One should know that the USA managed to reduce its debt by financial repression after the Second World War. The national debt of the USA fell by almost half between 1945 and 1955 due to the financial repression – on the other hand, the savers were expropriated by this half.

The Bundesbank also published this:

“In recent decades, negative real interest rates have even been the rule rather than the exception. Even before the financial crisis, in the 1970s, early 1990s, and 2000s, bank customers did not receive any inflation-compensating interest rates, especially on their savings deposits. These phases of real negative interest rates even historically outweighed …”.

At the moment there is another expropriation of savers in Europe due to the financial repression. The global low-interest policy of the central banks and the large-scale purchase programs of government bonds are nothing more than a huge global redistribution of wealth. The result is the same as if states were introducing a wealth tax on savings. The current variant of expropriation, however, is much more elegant, does not bring people onto the streets, and does not cost politicians their offices. The losers are the owners of financial assets such as savings books, account balances, overnight and time deposit accounts.

Negative real interest rates lead to a loss of assets for savers who are invested in overnight money, savings books, or federal bonds. Even if the saver does not immediately see the expropriation – the hidden depreciation of money leads to a loss of purchasing power. After one year the 10,000 EUR on the bankbook may still be 10,000 EUR but in one year I will not get the same value as today. On the other hand, negative real interest rates have a price-driving effect on investments intangible assets such as real estate or shares (products become more expensive).

Investments in tangible assets are investments in which the investor acquires a real equivalent value. Monetary values, on the other hand, are usually based on a promise. Real assets include real estate, precious metals and shares.

What is the real value of a property? Property has a material value that results from all the elements built into it, the value of the land on which the property stands, and a capitalized value if the property is let. It is similar to a share, i.e. participation in a company. In the case of a share, the combination of the tangible value and the capitalised value constitutes the actual real value. The capitalised earnings value is much more important here than in the case of the leased property. A company has assets such as land and real estate, machinery, or patents. Above all, if it has a superior business model and outstanding managers, the result is a capitalized earnings value that can protect the investor from inflation and financial repression and, in addition, brings an increase in assets.

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might still like these posts

Finance Blog

The EU Europe of Insolvency (guest article by Markus Miller)

In this guest article, author and economic expert Markus Miller warns of impending insolvency and calls on investors to act responsibly and rationally.

The underestimated risks of ETFs and passive investing

Anyone thinking about investing money today will sooner or later come into contact with Exchange Traded Funds.

LIGHT Foundation: The multi-generation model for your capital protection (guest article by Markus Miller)

Insurance policies from the Principality of Liechtenstein offer you foundation-like advantages and are already ideally suited for professional structuring models for contract sums from €50,000.