Guest article by Markus Miller

The EU-Europe of the payment incapacity

2. November | Asset protection

Responsible for the content of this guest article is Markus Miller, founder of the Spanish media and consulting company GEOPOLITICAL.BIZ S.L.U. As managing partner, he coordinates an international information and communication network of tax advisors, lawyers, and business and financial experts.

This post is a guest article by Markus Miller, founder of the Spanish media and consulting company GEOPOLITICAL.BIZ S.L.U. As managing partner, he coordinates an international information and communication network of tax advisors, lawyers, and business and financial experts.

The EU Europe of Insolvency

from Markus Miller

Leading German economic institutes and the German government have forecast a recession (i.e. a decline in economic output) of 0.4% for 2023. Recovery from the aftermath of the crisis months of the Corona pandemic and the still ongoing war in Ukraine is not expected until 2024, among other things due to the drastic increase in prices for energy imports.

The inflation rate is expected to fall from the current 10% in September 2022 to around 7% in 2023, according to the autumn projection of the German Federal Minister of Economics, Robert Habeck. Please realize the significance: On top of the now already enormously increased prices, another 7% would then be added!

Like butter in the sun: The financial reserves of many citizens are melting away!

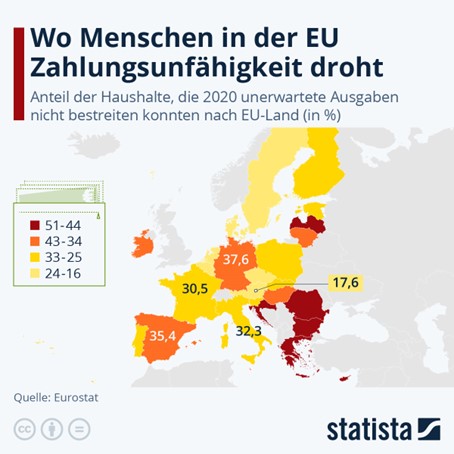

Inflationary pressures are also expected to fall as a result of the €200 billion “defensive umbrella” designed to ease the burden on citizens and companies with regard to payments for electricity and gas from the spring. Data from Eurostat shows that already in 2020, more than a third of German households did not have enough money to settle unexpected payments.

With a share of around 38 percent, Germany is thus in the top third in an EU comparison, as the above Statista graphic illustrates. There are even more households with payment difficulties, particularly in Southeastern and Eastern Europe. Greece is at the top of the ranking. Here, around half of all households were unable to make potential additional payments in 2020, and the proportion was also almost 50% in Croatia and Romania. Some neighboring German countries fare much better. In the Netherlands and Austria, for example, the corresponding rate was only 19% and 18%.

A closer look at the data reveals that households with dependent children in particular are potentially more likely to run into payment difficulties. On average in the EU, 32% of households without children fell into the corresponding pattern, while the figure for households with children was 34% overall. If we isolate single-parent households, the rate even reaches 57%.

In Ireland, Greece, and Cyprus, more than 70% of all single-parent households fall into this category. However, one limitation must be noted when analyzing the data: According to Eurostat, the indicator refers to household assets; income and expenditure were not considered here. Accordingly, the values reflect financial security rather than income levels. However, this does not make the values any better but highlights the lack of reserves that many people have for crisis situations.

The specter of insolvency is becoming a reality for more and more states and citizens

Please always keep in mind:

As a citizen, you vouch for your state!Markus Miller

Fear of inflation fears that housing will become unaffordable and worries that the economic situation will deteriorate rank in the top three places on the current “fear scale” among Germans. Tax increases follow in fourth place, and this concern is also more than justified. States are facing gigantic mountains of debt due to the multi-layered rescue packages that had to be put together as a result of the crises in recent years. Before a state becomes insolvent, it can ask its citizens to pay, first and foremost the asset holders and taxpayers. Please always keep in mind: As a citizen, you vouch for your state!

Politics even poses increasing risks to citizens’ and property rights. Just like greed, however, fear is a very bad advisor. That is why your rational, self-determined, and self-responsible action is called for since politics has lost its protective functions.

Mit den besten Grüßen

Markus Miller

Chief Analyst

Capital protection private and CRYPTO-X

Want to learn more about asset protection?

Did you like the article? Share it!

You might still like these posts

Finance Blog

The underestimated danger of financial repression

In troubled times, investors are looking for security for their assets. But what does “security” mean?

The unfounded fear of price fluctuations

Fear is innate to all people and therefore a constant companion. Originally it served to protect people from danger.

What happened in March ’19?

The first quarter of 2019 is already over again and the worries from quarter 4 of 2018 seem to have long been forgotten. What else happened in march?