The snow falls quietly, the markets crash loudly?

Dezember 23, 2018 | Latest News

While the shops have been boosting the Christmas business for weeks now and customers who enjoy drinking mulled wine have been served at Glühwein stands, many investors are preoccupied with the question of all questions: Is there still a year-end rally? Why we don’t care about this question, and why you shouldn’t care about it either, can be read in our little Christmas article:

What do the big ones do?

While Microsoft, Alphabet (Google) and Amazon present gigantic figures, prices are falling for companies. Amazon has temporarily fallen by 25% compared to its annual high. Amazon is constantly announcing new records:

Amazon announces record-breaking holiday shopping weekend: Cyber Monday once again becomes the Single Biggest Shopping Day in the Company’s History with the most products ordered worldwide (…) Amazon Customers worldwide ordered more than 18 Million Toys and More than 13 Million Fashion Items (…) Sales by small and medium-sized businesses worldwide grew more than 20 % on Black Friday Year-Over-Year.

But not only US companies can look brightly into the future. Even if the bare figures don’t always reveal it, strong price losses are not always a bad omen. MTU Aero Engines is listed on the MDAX. This great company also suffered a price loss of almost 20% in just two months. But is this due to the company itself? MTU announced on Capital Markets Day 2018:

Better organic growth prospects in all segments

Continued investment in capacity expansion and automation

Long-term targets for profit and free cash flow confirmed

Most price losses are driven by speculative investors. Investors who try to make fast money and investors who follow the masses for fear – because they don’t know what they are doing.

The advantage of price fluctuation

The fact that “our” companies have also suffered price losses in recent months is okay for us – even an advantage. Price fluctuations offer us the opportunity to pay only 60 cents for the value of a share of 1€. Or to get for the value of a share of 1€ also times 2€. Fortunately there are these fluctuations. Fortunately, there are irrational market participants who buy and sell entire funds, ETFs, indices like wild, bet, hedge and “swim” in the market. And fortunately there are speculative investors who do not look at individual companies and follow statements à la: “Important support achieved in the short scenario”, “the bears are at an advantage”, “buy signals are scarce and the new low has clouded the chart”, “the price level has been defended on a daily closing price basis” – the stock market variant of “crow the cock on the manure, the weather changes or it stays as it is”.

Why signals are misleading

We do not look at the markets and only then judge where we are going. Nor do we look at the charts and buy or sell by “signals”. Rather, we take a close look at the individual company – to be honest, even for months and analyze it down to the smallest detail – and its competitors. And then we look at the price. We are value investors. If the price is okay, we buy the stock and hold it for years, as long as the company is doing well and the price is not 20€ if it is worth 10€.

And so we can live well with the share price performance of these healthy companies again this year: +30% at Amazon, +15% at MTU, -2% at Alphabet and +20% at Microsoft.

We therefore hope that you too are already a value investor and can look forward to the Christmas season in a relaxed manner. And if not, we would be delighted if you would join us in the New Year on this path and become a shareholder with our value philosophy.

Best wishes and a happy holiday with your friends and family.

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might still like these posts

Finance Blog

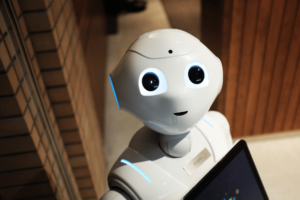

Artificial intelligence in asset management

Every day, various forms of artificial intelligence (AI) make our lives easier – be it during a conversation with Alexa, in the form of self-driving cars and parking aids in traffic, or during a visit to the doctor, where our data is compared with millions of others in order to obtain an early diagnosis. The financial industry has also been experimenting with AI and algorithms for some time now

The superiority of the stock investment

In the long run, returns on equities outperform the returns on all forms of investment such as bonds, cash, precious metals, or even real estate by far.

Market commentary: Uncertainties lead to short-term price drops

Macroeconomic and geopolitical issues are resulting in uncertainties and leading to higher volatility on the capital markets.