Estably Blog

Market commentary: Market commentary: Uncertainties lead to short-term price drops/b>

February 21 | Market commentary

In this market commentary you will learn,

- why our companies are fighting the rising inflation are prepared,

- The extent to which the end of the pandemic is responsible for a distorted perception of the company’s results. provides,

- what impact an escalation of the Russia-Ukraine conflict would have on our portfolios, and

- what our further course of action looks like.

Supply bottlenecks, inflation & interest rate environment

The currently very present topic of inflation, which is being inflated in the short term by supply bottlenecks in global value chains and the Russia conflict in the form of higher energy prices, is leading to uncertainty on the markets. This results in concerns about a permanent reversal in interest rate policy, which would have an impact on company valuations. In theory, valuations of companies as well as bonds are affected by changes in long-term interest rates. Since cash flows in the future are attributed less value (a higher discount factor) when interest rates rise, valuations of growing companies whose enterprise values are based on future cash flows are more affected in this market phase. Irrespective of interest rate developments, however, we see only minimal impact on the fundamental developments of our companies. Following price declines and the possibility of passing on inflation rates to customers, this in turn actually leads to higher expected returns in subsequent years.

Based on current data, we do not expect interest rates to change fundamentally in the longer term compared with the period before COVID. Despite the return of the restrictive interest rate policy and the expected moderate increase in the key interest rate, we believe that the fog will lift once again and that investors looking for investments will thus probably be willing to look beyond the next quarterly results. The past has also shown that, over the long term, there is no correlation between interest rate hikes and returns realized over a longer period of time.

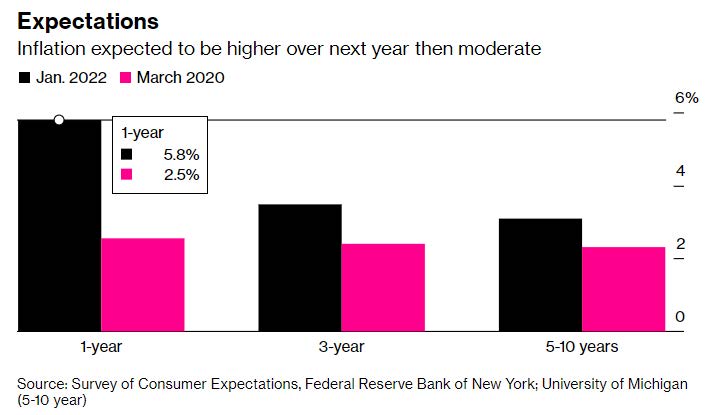

Inflation rates peaked at 7.5% in the U.S. in January. Through a combination of interest rate hikes, demand normalization, and unwound COVID restrictions that ease pressure on global supply chains, we expect inflation to gradually level off after peaking in early 2022. The 3-year, as well as 5-10 year, expectations for long-term inflation rates by consumers are barely up from March 2020 (pre-pandemic), according to recent studies.

In the meantime, we believe we have companies in our portfolio that are able to offset increased costs due to their pedigree, pricing power and scalable business models. More than half of our companies’ sales are generated outside the U.S., where macroeconomic developments as well as monetary policy sometimes take a different course (example China, where the key interest rate was slightly eased in January). Our companies in the USA and Europe also have a high level of pricing power and have so far been able to successfully pass on inflation rates to customers. In combination with scalable business models (as with some digital platforms), various companies would even have the opportunity to offset the impact of inflation by disproportionately increasing profits.

We currently see the peak of all uncertainties related to inflation and interest rate policy and expect circumstances to improve in the coming quarters.

Strong comparative quarters & redistribution of consumption

In addition to the developments described above, the end of the pandemic and the fact that very strong comparative quarters were recorded in the previous year also lead to a visual distortion. This gives the impression that the growth of some companies is flattening out immediately. However, the fundamental developments at our companies are largely in line with our expectations – while short-term developments are comprehensible to us and we do not attach undue importance to short-term results, long-term trends remain intact.

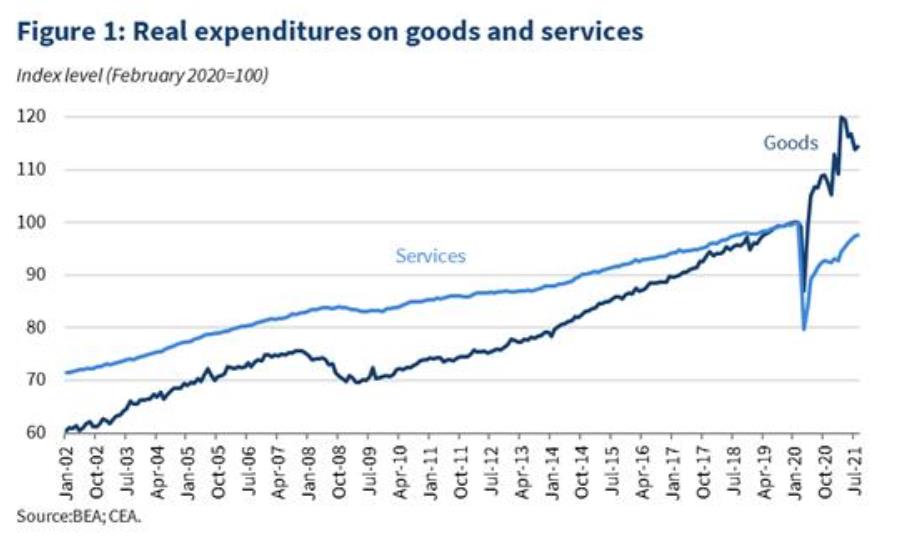

Fiscal policy had a significant impact on crisis management in the previous year with extensive subsidies and resulted in a redistribution of consumption away from services (such as gastronomy, hotels, entertainment, travel) to products (above all electronics) with generous support from the American as well as the European population.

These developments had a disproportionate impact on the growth of digital business models in particular, and in contrast to traditional sales channels, business areas related to e-commerce, streaming or fintech benefited. With the reopening of entire economic sectors, the natural reversal of this effect is now following, which is also accelerated by bottlenecks in supply chains and inflationary pressure. With high growth rates in the previous year and the elimination of subsidized consumption, the short-term growth of some companies is expected to flatten out at the beginning of this year. In the long term, however, neither the added value offered to customers nor the size of the addressable market has changed, and we therefore do not see any impact on the business models of our portfolio companies.

The exceptionally good results achieved by some companies in the previous year are currently inconvenient for us, as inflation fears and geopolitical conflicts mean that particular attention is being paid to short-term developments. The forecasts of various companies for the first quarter are less positive than usual on a comparative basis and the capital market is getting the erroneous impression that certain companies have only benefited from COVID and that long-term growth drivers are now reversing.

Geopolitical conflict between NATO and Russia

With the geopolitical conflict between Ukraine and Russia coming to a head, an additional issue is coming to the fore and increasing the uncertainties on the capital market.

Should the conflict escalate further, sanctions against Russia by NATO members and allies are to be expected. In addition to steps against individual oligarchs, export controls of US-based technology as well as Cuts for the Russian financial market mentioned as possible sanctions. However, none of our internationally active companies is overly dependent on the Russian market. The effects of possible sanctions thus arise primarily in the form of increased energy prices by the potential loss of Russian exports to Europe, which continues to be particularly dependent on Russian natural gas. Increased energy prices are already having an impact on manufacturing companies in the quarter just ended. However, as mentioned in the previous chapter, changes in energy costs can be passed on to customers with a slight delay. Moreover, the extent of sanctions remains questionable due to the strong dependence of various NATO members on the Russian energy market.

In the event of a worsening of the conflict with the introduction of sanctions, stronger effects on the Russian financial market in the form of Currency devaluation and Valuation declines due to escape of western investors not to be excluded. However, geopolitical and macroeconomic risks were already priced into valuations of Russian companies before the outbreak of the conflict and we also take the risk into account in our analysis and valuation process.

Further strategy & outlook

We continue to see our portfolios very well positioned and remain true to our strategy. In an inflationary environment, many of our companies are able to pass on the increased costs due to their market position and differentiated products or services and are at most affected by short-term effects due to higher expenditures for working capital expansion. As soon as inflationary pressures ease, the negative impact on profitability will reverse in many cases and should even have positive effects on profits and cash flows in the short term. In addition, interest rate hikes in combination with easing regarding COVID restrictions should lead to a general normalization of supply and demand over the next quarters and thus improve the inflation environment and the situation regarding supply difficulties. With regard to geopolitical risks, we continuously monitor events and consider the risk/reward ratio of such investments to be adequately reflected in our portfolio construction.

In times of increased volatility, we would like to explicitly advise against tactical asset allocation and refrain from a specific build-up of the cash ratio. In such a phase, there is a risk that the broad mass of market participants will have the same thought and thus trade procyclically and thus at exactly the wrong time. Moreover, price recoveries in such an environment often happen quite unexpectedly and in the form of a few very strong days on the stock market. Thus, the chance of negatively impacting long-term returns when attempting market timing is very high.

This is confirmed in past observations of the markets. If one had invested €10,000 in the S&P 500 in 2000 and remained invested throughout, an investor would have increased their portfolio balance to €32,421 by 12/31/2019 and earned an annual return of 6.06% or a total return of 224.21%. If the investor had missed the best 10 days, it would have turned into only €16,180 and the returns would have been reduced to 2.44% (annual) or 61.80% (total).

Over the long term, we continue to see equities as the most attractive asset class. Our selective screening process, backed by months of detailed analysis, allows us to include companies with very attractive growth opportunities and high crisis resistance in our portfolios and to have high confidence in their long-term value growth potential despite general uncertainties in the market. At this point we would like to emphasize that behind the retention of all companies in the portfolio there is always an active decision, which is constantly evaluated and made on the basis of detailed research work.

We can assure you that we always do our best to optimally protect and increase our clients’ assets in the long term. Both employees and partners of Estably Vermögensverwaltung AG are faithfully invested in their private portfolios according to our strategy.

Do you have questions about our market commentary?

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

Did you like our article? Share it!

You might also like these posts

Finance Blog

Annual commentary 2023

In our annual commentary, we would like to share our thoughts on an eventful 2023 and provide an outlook for the future.

LIGHT Foundation: The multi-generation model for your capital protection (guest article by Markus Miller)

Insurance policies from the Principality of Liechtenstein offer you foundation-like advantages and are already ideally suited for professional structuring models for contract sums from €50,000.

Half-year commentary 2023: From crisis to recovery

After a very turbulent 2022, the first half of 2023 saw a stabilisation in the capital markets, with strong recoveries in certain sectors.