Estably Blog

The Right Mindset for the Next Crash

September 15, 2021 | Crisis Management

We don’t know when the next crash will come. Nobody does. What we do know is that a crash will happen again at some point.

We’re not pessimistic, just realistic. It’s a proven fact: Since 1950, the S&P 500 has seen double-digit declines on average almost every two years.

The good news? Every single crash has been followed sooner or later by a recovery. And with the right approach, you can even emerge as a winner from the next crisis!

Don’t Play Hero

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”

Peter Lynch, Value Investor

Don’t try to do damage control and sell your shares in the middle of the crisis.

Best case scenario, you might manage to bail out just before the low point. Soon, however, you would be faced with a much harder decision: When do I get back in?

After all, the particularly bad days are usually followed by exceptionally good days. If you are not fully invested then, you miss out on a large part of the return:

For example, if you had invested $10,000 in the S&P 500 in 1998 without missing a day, you would have quadrupled your initial investment 20 years later to $40,000. If you had only missed the 10(!) best stock market days during this period, you would have ended up with only $20,000.

So after 20 years of investing, just 10 single days made the difference between 100% and 300% return.

Recovery Often Comes Faster Than Expected

Admittedly, it’s not easy, especially for newcomers to the stock market, to watch share prices plummet and their savings lose value. Even more so when you are not supposed to intervene. However, stock markets often recover faster than expected:

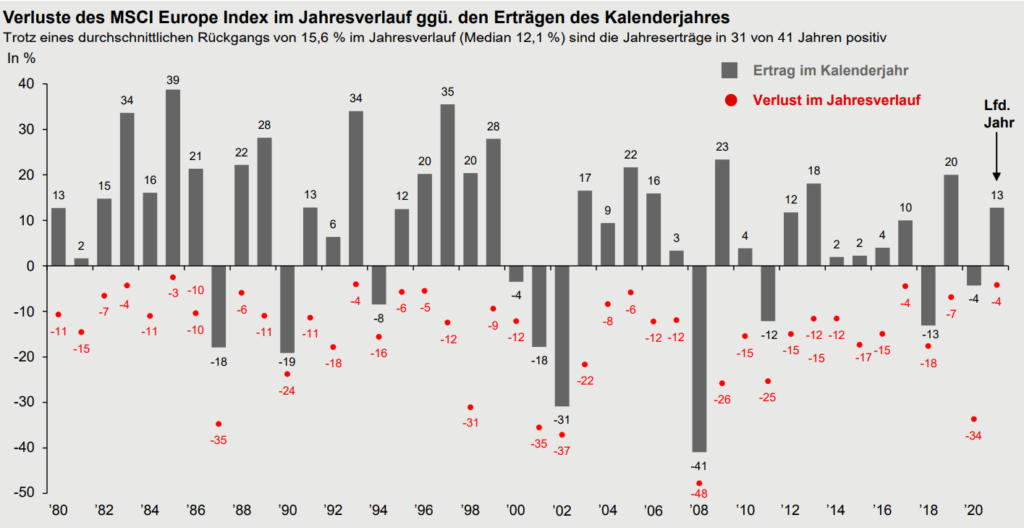

The S&P 500 suffered average intra-year lows of 14.3% from 1980-2020 but still managed a positive return at the end of the year in 31 of 41 cases.

The lesson? Stay cool, even when markets are down double digits. The probability of a positive result at the end of the year is high.

An impressive example of a rapid stock market recovery could be observed in last year’s COVID crash.

On March 23, 2020, the S&P 500 reached its low point. Barely six months later, it had already returned to its pre-crash level, and less than a year and a half later (in August 2021), the index had even doubled since its low.

This means that anyone who bought at the low point of the Corona crisis was able to enjoy a return of 100% one and a half years later. This is the fastest doubling after a stock market crash since the Second World War.

In Every Crisis, There is an Opportunity

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

Warren Buffett, Value Investor

Do you want to behave like an experienced value investor in the next crisis?

Then swim against the tide and invest more when prices have fallen, provided you have the necessary funds.

Since every stock market crash was sooner or later followed by a recovery, in the past it was precisely these lows that were profitable entry points.

Driven by emotions and expectations, many market participants underestimate the actual value of a company during a depressive phase. Often, however, a crisis only affects the share price and not the intrinsic value of a company.

Our task is to recognize such cases and to take advantage of the emotional fluctuations of the market. If we have the chance to buy a still excellent company at a lower price, we gratefully accept this offer.

Don’t Make it Unnecessarily Difficult for Yourself

A well-intended advice: Try to ignore headlines about the financial markets. If it becomes difficult to resist temptation, we recommend solving the problem of self-control analogously to Ulysses in Homer’s story with the sirens.

In order to resist the sirens’ song and not be shipwrecked by it, he plugged his crew’s ears with wax and tied himself to the mast so as not to get to the wheel.

Analogously, our advice is: do not look at your portfolios for a longer period of time and avoid all financial news if possible. The positive effects of this approach have been proven many times. We keep our ears open for you in the meantime!

Crisis-Resistant Companies in our Portfolios Unternehmen in unseren Portfolios

Finally, we would like to draw your attention to the fact that our portfolios are different from the stock markets or indices.

Our stocks are handpicked. One of the most important criteria in selecting our companies is their resistance to crises. We prefer to invest in companies that have already survived crises in the past and have sufficient liquid assets to survive further ones.

Added to this is the concept of the “margin of safety“. The greater the difference between the actual value of the company and the share price, the further the company’s value may fall in a weaker economic phase in order to still be above the share price.

Our risk management therefore starts with the selection of stocks, not just with the crash.

When a crash occurs, we reanalyze our portfolios. Which companies have undergone fundamental changes as a result of the crisis? Which companies are now even more attractive in terms of price to make any additions?

For example, after assessing the impact of the COVID crisis on our companies, we only sold a few and bought others. Particularly during crises, we believe it has also proven worthwhile to rely on the expertise of our portfolio managers instead of leaving the hard decisions to algorithms.

We’re Here for You

“When written in Chinese, the word ‘crisis’ is composed of two characters. One represents danger and the other represents opportunity.”

Max Frisch, Schriftsteller

Viewed rationally, a stock market crash is far less threatening than it is portrayed by the media.

In summary, our tips for you:

- Stay calm and do not sell out of a panic, otherwise you will miss the profitable upswing.

- Trust in the fact that so far every crisis has been followed by a recovery.

- As a long-term investor, crises also always present excellent entry opportunities.

We want you to master the next crisis with the right attitude. Not only for the sake of your nerves, but also to prevent you from unnecessarily diminishing your assets through ill-considered actions.

And when the time really comes, we will of course be there to support you personally as your trusted partner.

You got further questions regarding our strategy?

Estably is the first digital asset management company from Liechtenstein to offer first-class wealth management from € 20,000 through a mix of technology and human investment expertise. Thanks to the portfolio managers' many years of experience in the field of value investing, above-average returns are targeted. This is intended to make professional asset management, previously available exclusively to large investors, accessible to everyone - conveniently, transparently, and profitably.

Did you like the article? Share it!

You might still like these posts

Finance Blog

The underestimated danger of financial repression

In troubled times, investors are looking for security for their assets. But what does “security” mean?

Market commentary: Winners of the pandemic are correcting

In the last two years (since April 2020), the stock markets have almost exclusively risen. There have been no notable setbacks, and the U.S. market in particular.

Artificial intelligence in asset management

Every day, various forms of artificial intelligence (AI) make our lives easier – be it during a conversation with Alexa, in the form of self-driving cars and parking aids in traffic, or during a visit to the doctor, where our data is compared with millions of others in order to obtain an early diagnosis. The financial industry has also been experimenting with AI and algorithms for some time now