The perfect time to enter

Is now the right time to invest?

June 10, 2020 | Tips

Catching the perfect moment and beating the market – the supposed dream of every investor. In practice, however, this rarely succeeds because: no one can look into the future and predict when exactly the markets will go up or fall again.

For experienced investors, timing is not important in the long run when investing, but inexperienced investors in particular often wait for the “perfect” moment. But why waiting can be expensive, and what experienced investors do right, you can find out here.

Time is more important than timing

Waiting too long for the right time can be expensive, because the best days on the stock market usually come completely unexpectedly. Not being invested on these days means losing a significant part of the return.

For example, if you had invested USD 10,000 in the S&P 500 in 1998 without missing a day, you would have quadrupled your initial investment to USD 40,000 after 20 years.

If you had only missed the 10(!) best stock market days during this period, you would only have 20,000 USD in your account at the end.

So after 20 years of investing, it was just 10 single days that made the difference between 100% and 300% return.

Another example: an investment in the MSCI Europe, fully invested from 2004-2018, yielded an annual return of 5.3%. Without the 10 best days, the return shrinks to a meagre 0.5% per year.

In both cases, it would have been impossible to predict the 10 best stock market days. So much more important than timing is that you are invested at all. Because tomorrow could already be one of those days that makes the difference in the long run.

Shares are superior in the long term

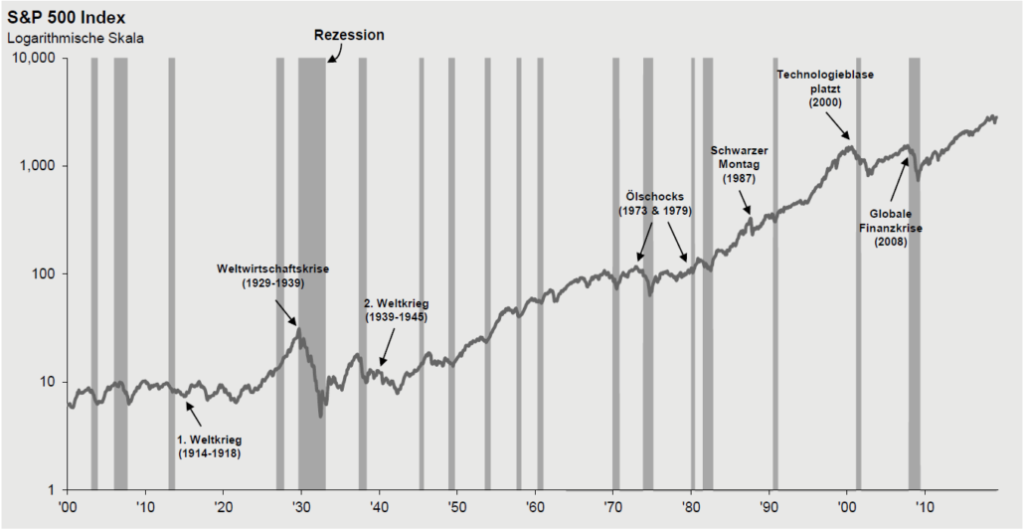

Over the last 100 years, share investments have achieved an annual real return (less inflation) of +5.2%. Getting the timing right in the short term is speculative, since unpredictable environmental factors of a political or economic nature, combined with people’s irrational actions, always move the entire market out of control.

On the other hand, if you think long-term, you invest in a rising market. If you also exclude overvalued companies from your investments in times of bubbles, you can even survive crises much more unscathed.

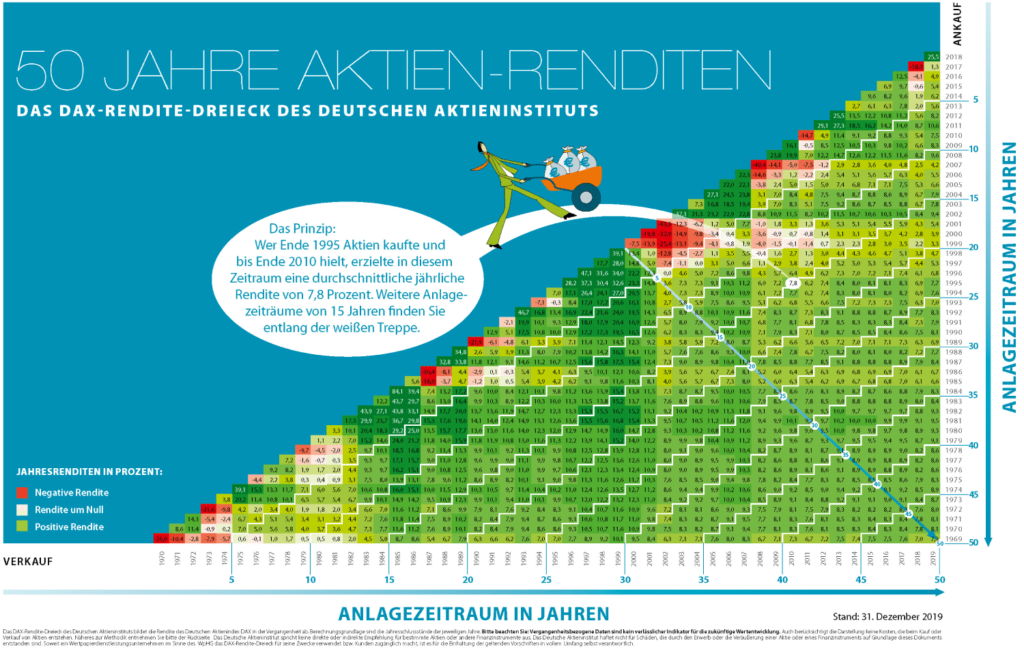

The yield triangle from the German Stock Institute also highlights that long-term investments end positively in the vast majority of cases.

To find out an exact return, choose a buying year on the right axis and connect it to the selling year on the lower axis. Do you recognise the trend? The longer you hold a share, the more likely you are to end up in the green and achieve a positive return. A long-term investment horizon is thus by far more important – and above all easier for you to influence – than the perfect entry point.

Are you asking the right question?

The question you should ask yourself is not whether and when to invest in shares. Rather, you should ask yourself whether you will succeed in finding a solid company at an attractive price.

And that is exactly where we can help you. Our portfolio managers analyse potential companies and their competitors down to the smallest detail over a period of months until a decision is made for or against an investment.

If we decide in favour of a company, we hold on to it until there is a significant change in our investment thesis. Be it through a new strategic orientation of the company, a major change in external factors or a too strong increase in the share price in relation to the actual value of the company. Only when we no longer consider an investment to be profitable, or we consider another company to be even more attractive, is it sold again.

Adapt the mindset of an experienced investor

If you have been waiting for the right time to enter the market, you should be aware of the following:

- No one can constantly predict the short-term development of the market.

- Shares are in a long-term rising market.

- It is not the timing that matters, but rather the choice of investments.

You can always have the misfortune of investing in falling markets in the short term. What you can do about it? Stick with it for the long term. Don’t sell after one negative year. Not even after two. Instead, buy more cheaply. Coupled with investments in high-quality companies, you will also get through bad years and be rewarded with discipline after some time.

Estably is the first digital asset management company from Liechtenstein to offer first-class wealth management from € 20,000 through a mix of technology and human investment expertise. Thanks to the portfolio managers' many years of experience in the field of value investing, above-average returns are targeted. This is intended to make professional asset management, previously available exclusively to large investors, accessible to everyone - conveniently, transparently, and profitably.

Did you like the article? Share it!

You might still like these posts

Finance Blog

What makes the rich get richer and richer

Half of the world’s wealth is held by millionaires, most of them are located in the US, followed by China, Japan, the UK and Switzerland.

Is now the right time to invest?

Catch the perfect moment and beat the market – the supposed dream of every investor. In practice, however, this rarely succeeds, because: nobody can look into the future and predict when exactly the markets will rise or fall again.

Gold – Attractive and everlasting (Interview with Andreas Wagner)

In an interview with Businesstalk-Kudamm.de, Estably Managing Director Andreas Wagner explains his views on gold.