Estably Blog | Market commentary

Review & outlook:

Estably annual commentary 2023

Published on 25.01.2024

The year 2023 on the capital markets

In our annual commentary, we provide you with an overview of events on the capital markets and an update on the economic environment, particularly with regard to inflation, interest rate trends and the economy. We also highlight some important lessons for investors from the past year and show why we continue to look to the future with great conviction, even after this partial recovery.

As in the previous year, events on the capital markets in 2023 were strongly characterized by expectations regarding inflation, interest rates and the economy. Positive developments in these macroeconomic factors calmed certain investor fears, resulting in a strong recovery on the markets in the first seven months of the year. After a slight setback between August and October, the indices closed the year with another two very strong months. Both the US “S&P 500” (+26.3%), the global “MSCI World” index (+23.8%) and the German “DAX” index (+20.3%) ended the year with significant gains.

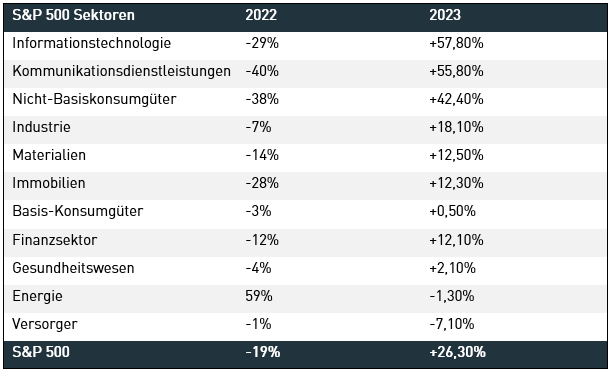

In terms of sector performance, the picture was contrary to the previous year. The gradual clearing of some of the dark clouds that had loomed over the markets in 2022 led investors to focus more on the future again. As a result, there was a sector rotation from the inflation winners (energy) and safe havens (consumer staples & utilities) towards the information technology, communication services and non-basic consumer goods sectors, whose performance was thus able to return to past longer-term trends.

Inflation, interest rates and the economy remained the number one topic and influencing factor on the markets throughout the year. Nevertheless, improved company results, particularly in the top 3 sectors, also fuelled the recovery. In addition, as has often been the case in the past, the share prices of certain companies were driven up sharply by a megatrend – in this case “artificial intelligence”. Even if the future influence is undisputed, we believe that the underlying share price developments were only justified to a certain extent and in some cases reflected too much euphoria.

At an individual level, there were major discrepancies in terms of share price performance. In the S&P 500, the 10 largest companies in the index achieved a performance of 62% and were responsible for 86% of the total index performance. By comparison, the performance of the remaining 490 companies was 8% and even briefly slipped into negative territory during the aforementioned setback between August and October.

The gap is also clearly illustrated by the fact that 72% (52% on average) of shares underperformed the index in 2023, the second-highest figure since 1980.

After a historically difficult year for the bond markets in 2022, investors had positive expectations for 2023. However, the underestimation of the extent of interest rate rises and the ongoing strict rhetoric from central banks led to persistent headwinds in the first three quarters of the year. As at 30 September 2023, the broad US bond market posted a negative annual performance of -1.21%, while the European bond market recorded a minimally positive performance of +0.59%. Although investors were confident at this point that interest rates had peaked, they remained cautious about how long they would remain at this level.

A series of positive inflation figures and encouraging comments from central banks contributed to a certain degree of calm. This resulted in falling market interest rates and consequently a rise in bond prices. Corporate bonds also benefited from lower risk premiums (spreads). This led to a very strong performance on the bond markets in the fourth quarter. Both the general bond indices in the USA (+5.53%) and in the eurozone (+7.19%) as well as corporate bonds in the respective regions (+8.52% and +8.19% respectively) ended the year on a positive note despite initial uncertainties.

The macro environment

At the end of 2022, the inflation rate in both the US (6.5%) and Europe (9.2%) was well above the long-term target value. Further interest rate hikes were expected, which in turn fuelled fears of falling corporate profits and a general deterioration in the economic environment. 12 months later, some of these concerns have subsided and the very pessimistic and short-term view has gradually been replaced by a more optimistic picture. It continues to look like inflation can be successfully brought under control in both the US and Europe.

Inflation rate USA

The inflation rate in the US stood at 3.4% at the end of the year and is gradually approaching the long-term target of 2%. In addition to a restrictive monetary policy, the normalisation of supply chain problems and bottlenecks following the COVID pandemic, a disproportionate increase in productivity compared to wage increases and a certain weakness in Europe and China were responsible for this development. Although house and rental prices continue to be a driver of inflation, the time lag in taking current market movements into account means that this category is also expected to ease in the foreseeable future.

Eurozone inflation rate

Similar developments can also be observed in the eurozone. After peaking at 10.6% in October 2022, the inflation rate at the end of 2023 was 2.9%. Due to the different economic circumstances, different developments were to be expected in the respective countries. Some countries, such as Belgium, Italy and the Netherlands, are already below the 2% mark.

However, the general trend is also correct in the remaining countries. Compared to the end of 2022, when nine countries in the eurozone had double-digit inflation rates, the highest inflation rate is now 6.6%, while 17 of the 20 countries are below 5%. This means that important steps have also been taken in the eurozone to combat inflation.

Interest rate environment

At the current level, the interest rate environment appears restrictive enough and has so far had a significant influence on curbing inflation. Both the US Federal Reserve and the European Central Bank have left interest rates unchanged in recent months in order to determine the further impact, which in some cases only becomes apparent with a time lag – a confirming sign. In the US, there are already signs of a series of interest rate cuts in 2024, while the ECB’s rhetoric remains stricter.

Nevertheless, it looks as though interest rates have peaked in both regions.

It was originally assumed that the restrictive monetary policy would have to lead to a generalized recession in order to bring inflation back under control. However, the economic environment in the US continues to hold up and the possibility of a rolling recession described in our half-yearly letter has so far materialized.

The weakness observed in the real estate market and the industrial sector at the end of 2022 continued in 2023, although stabilisation was observed and a recovery is already foreseeable in some cases due to the interest rate dynamics (real estate) and the far advanced inventory reduction in the supply chains (industry). The banking sector also came under pressure in March, although this was not a credit default problem as in the financial crisis, but rather inadequate risk management with regard to interest rate changes in combination with a riskier deposit base. The regulators (FED & FDIC) stepped in immediately, protected the affected customers via the deposit protection scheme and implemented measures to avoid such scenarios in the future. The problem was thus quickly contained and had no far-reaching consequences.

US economic situation

The robustness of the labour market continues to stand out positively. At 3.70%, the unemployment rate in the US remains at a very low level. Although the number of job vacancies is declining slightly, it is still above the pre-COVID pandemic level. This trend is therefore more akin to normalisation and reduces the risk of a wage-price spiral. In addition, the US consumer remains very well positioned. Purchasing power remains high due to the robust labour market and increased productivity in combination with wage growth that exceeds inflation (= increased real wages). Household balance sheets also remain solid.

In addition, longer-term trends such as onshoring (scaling back production processes) and the ongoing investment cycle in the areas of renewable energies and electrification are providing a tailwind that will last for many years to come. Employment in the construction industry, for example, is at an all-time high, underlining the current robustness of the US economy.

European economic situation

In contrast, the economy in Europe is currently characterized by a certain weakness, particularly in the manufacturing sectors. The combination of a restrictive monetary policy, weakness in the export business and the aftermath of the energy crisis are the driving factors here. Consumers are also more cautious in the current environment, which is putting pressure on consumer spending. However, the labour market has so far remained unaffected by these developments. The unemployment rate in both the EU (5.9%) and the eurozone (6.4%) is at a historically very low level. However, a change in trend could emerge in the current year. Surveys indicate a decline in hiring intentions, particularly in the manufacturing sector, due to the uncertain outlook for economic growth.

All in all, however, there has been a significant improvement in the macro environment over the last 12 months and the risks appear to be much lower.

Inflation in both the US and Europe is on a good path towards its long-term target and interest rates appear to have peaked. Ultimately, it is difficult to assess whether the restrictive monetary policy with its record interest rate hikes will have any negative after-effects.

However, there is currently very little to suggest that the environment will deteriorate significantly. In addition, the successful containment of inflation to date provides sufficient room for manoeuvre for central banks, which would have enough flexibility to make adjustments to monetary policy and stimulate economic growth again in the event of emerging or persistent weakness.

"The big money is not in buying or selling,

but in waiting"- Charlie Munger, Value Investor (1924-2023)

Lessons learnt from the past year

Regardless of the annual result, continuous reflection plays an important role in investing and both good and challenging phases provide important lessons. There were also some valuable insights for investors this year:

1. Share price losses & negative information: No reason to sell quality companies

In the short term, stock markets can be very strongly driven by psychological factors and emotions. This has been particularly evident in the recent past with individual companies. The combination of flattened growth after the end of the COVID pandemic and higher costs due to further anticipated growth put the results of many companies with a digital business model under severe pressure in the short term.

In a phase of extremely short investment horizons, the combination of negative information and strong price fluctuations led to a sharp downward spiral. At this point, we would like to remind you of a selection of headlines on various companies:

Due to the negative information situation and the sharp fall in share prices, one might be inclined to sell such positions for fear of further losses. However, selling would have been a very costly decision. A certain normalization of the environment and the successful implementation of various strategic initiatives led to improved fundamental results and, in combination with a general calming of the markets, this resulted in a gigantic recovery of individual stocks.

The strong share price performance of companies, some of which were most in doubt, contributed significantly to the recovery (performance for 2023 in each case): Meta Platforms (+194.1%), Spotify (+138%), Salesforce (+98.5%), Netflix (+65.1%) or Alphabet (+58.8%).

In such phases, it is important to allow for a natural fluctuation in valuations and fundamental developments as long as the investment thesis remains intact. The underlying quality of the companies should make it easier for investors to remain rational and calm even in such difficult phases in order to avoid any short-sighted reactions. While the presence of certain challenges in these companies over the past year cannot be denied, at the end of the day, there is no successful long-term company that has not faced challenges in its history. At the end of the day, a quality company is not characterised by a lack of challenges, but by its ability to overcome them successfully.

Even if this “buy and hold” approach can be painful in the short term, perseverance in difficult phases and trust in the selected companies is one of the most important factors for long-term investment success.

2. the flight to "safe harbours" would have drastically reduced the degree of recovery

In an environment driven by high inflation and various uncertainties, it was the energy, utilities and consumer staples sectors that benefited disproportionately from these conditions in 2022 and outperformed the market.

At the turn of the year, the mood on the markets remained very gloomy. Under these circumstances, the flight into safe or recently well-performing sectors may appear to be the right move. However, being guided by fear and panic in such phases harbours the risk of acting in line with the masses and therefore at precisely the wrong time.

In the past year, it was precisely the three sectors mentioned above that performed much worse than all other sectors and the market as a whole. By contrast, the losers from 2022, above all the information technology, communication services and consumer discretionary sectors, all performed strongly.

The performance of entire sectors can also be influenced by psychological factors in certain phases and can turn very unexpectedly. Instead of trying to anticipate short-term sector trends and capital flows, investors should focus on building a portfolio of different sectors and companies that have adequate upside potential based on fundamental factors (the long-term driver of share prices).

3. Investment decisions should never be based solely on the macro environment

Many economists, investors, entrepreneurs and consumers expected inflation to remain high in 2023, interest rates to rise further and a more severe downturn – surveys, for example, pointed to one of the most anticipated recessions.

In view of such prospects, a much more defensive positioning in the portfolio (e.g. building up liquidity) could be intuitive. Fundamentally, however, the markets are not a reflection of economic developments, but rather a reflection of market participants’ future expectations. In this scenario, waiting for the inflation target to be reached, a lower interest rate level or supportive arguments in favor of a robust economy would have led to the recovery seen this year being partially or possibly not at all taken part in.

Even if there can be greater price fluctuations in times of uncertainty, it is best to remain true to your investment strategy even in such a phase. In the past, in situations without a sudden unforeseen event, the markets have generally moved well ahead of economic developments, both on the way down and on the way up.

As a rule, stock markets often record their best days shortly after phases characterized by very high volatility and high uncertainty. The probability of success in predicting the exact timing of these ups and downs appears to be extremely low and Harbours the risk of only partially benefiting from the good phases on the stock markets, which are generally longer and stronger than the bad ones.

4. setbacks during the year are part of what happens on the stock market

Developments on the capital markets are never straightforward. Even in a generally good stock market year like 2023, there are phases in which uncertainties arise and ultimately lead to setbacks.

Between August and the end of October, the S&P 500 suffered a loss of over 10% during the year, which led to increased uncertainty again despite the generally positive performance in 2023. Anyone trading out of fear of further setbacks in this case would have missed out on at least part of the strong performance in the last two months of the year, for example +13.74% in the S&P 500.

In times of weak market phases, the best advice is to remain calm. A loss of -10% during the year has occurred on the stock market every 1.6 years in the past – a very common phenomenon.

Investors should generally refrain from market timing or hedging strategies. Even if volatility or losses could be contained for a short time in certain phases, it is precisely these measures that have the opposite effect in good phases, which are usually much stronger and last longer than the bad ones, and have a negative effect on long-term returns. True to one of the most famous quotes among value-oriented investors:

"Time in the market beats trying to time the market"

- Ken Fisher, Analyst

Ultimately, all these lessons have one thing in common: they are all based on the fundamental principles of value investing. The selective choice of quality companies and decisions characterized by long-termism and rationality form the foundation of this strategy. Not recognising the highs and lows of markets, sectors or individual stocks, but acting in a disciplined and rational manner in times of higher volatility is one of the most important factors for long-term investment success.

Looking to the future and our expectations

After another eventful year, it is time to look ahead to 2024 and beyond. After a good year on the stock markets and, above all, the very strong end to the year, one would think that a near-term slowdown would not be unlikely. Statistically, at least, this is not the case. In the past, after such a development over an observation period of 5 years, there was no increased occurrence of corrections either in short or long time intervals and the development continued to be very positive on average.

From a fundamental point of view, too, it does not seem unlikely to us that the general market will continue to develop positively. Nevertheless, it is quite possible that general market developments will be subject to a certain gravity over the next few years due to the relatively high valuations of the highly weighted companies in the share indices (S&P 500 & MSCI World). However, this possible dynamic has no real relevance for us. With the current portfolio structure, we feel that we are very well positioned to achieve good long-term performance due to various factors.

Greater market focus on fundamental developments

At present, it looks as though the general concerns about inflation, interest rates and the economy will continue to ease. Even though these factors will continue to be an issue, it is not unlikely that the markets will once again focus more on the fundamental data of companies.

In view of the strong performance of our companies so far in 2023 and the continued positive expectations, we would definitely benefit from this dynamic in such a scenario.

Continued recovery potential in a large number of sectors

The expected phenomenon that different sectors go through both the lows and the recovery at different times has now been confirmed. As described above, companies in the information technology, communication services and consumer discretionary sectors have seen a significant recovery over the past year, which is now reflected in normalised valuations.

In contrast, a large part of the recovery in other sectors has yet to materialise. We were able to turn these discrepancies to our advantage through targeted profit-taking and by adding companies at attractive valuations outside these sectors. As a result, our portfolio still has disproportionately high recovery potential.

Attractive opportunities away from the masses / the hustle and bustle

In times of greater uncertainty, it is generally the case that investors seek refuge in supposedly safe or larger companies. In the recent past, it has not been uncommon for “smaller” companies to see their share prices fall more sharply despite the same or even better fundamental data. This has resulted in a general valuation discrepancy between companies depending on their market capitalization.

With positive inflation figures and a continued robust economy, “smaller” (mid and small-cap) companies started to recover at the end of the year. However, the majority of the recovery is still pending. For example, the discount between the valuations of mid-cap and large-cap companies remains at 28% compared to the historical average. In terms of both number and weighting, just under half of our portfolio consists of companies in these two categories. Approaching a historically normalized ratio should give our portfolio an additional tailwind.

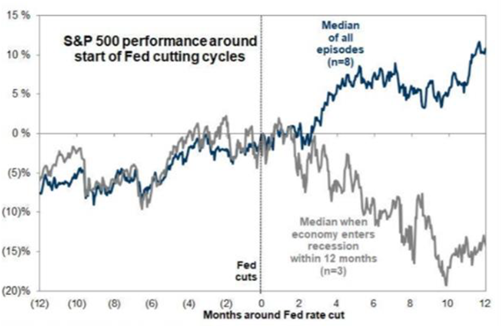

Interest rate cuts with a possible positive effect on the capital markets

Falling inflation rates could prompt central banks to lower interest rates again somewhat this year. When and how much interest rates will ultimately be lowered in the respective regions will depend on the course of inflation and economic development. In principle, falling interest rates are a positive driver for both equities and bonds. However, falling interest rates are also sometimes associated with difficult phases on the markets. This has to do with the fact that in past phases, central banks have tried to stimulate the economy with low interest rates in the face of a looming crisis.

The expectation of an impending recession led to price losses. However, in phases where interest rates were lowered outside of fears of recession, the trend in the past was generally positive. Based on current data, it appears that the US economy remains very robust, while the environment in Europe appears weaker, but no extraordinary crisis is foreseeable here either.

Bonds are an attractive asset class in the current interest rate environment

Even if the bond markets have briefly suffered greatly from the rise in interest rates, this is a temporary phenomenon. Falling prices lead to rising yields to maturity, as 100% of the nominal value is always repaid at the end of a bond’s term, provided the company does not run into payment difficulties. In addition, the current environment is generally more attractive for this asset class.

Although interest rates are expected to fall from their current level, a return to the zero interest rate policy that has largely prevailed over the last 15 years is unlikely. The higher interest rate level therefore offers the opportunity to reinvest the capital from maturing issues in higher-yielding bonds. Even if equities continue to be characterized by higher potential for value appreciation in the long term, bonds should allow higher returns than in recent years.

Concluding words

We hope that we have been able to give you an insight into our thoughts in our annual commentary and explain the reasons for our confidence. Nevertheless, the current year will again be characterized by countless topics that will keep investors and the markets busy. These include elections, especially in the USA, which will receive increased media coverage and are predicted to have possible implications for the capital markets. Investors are best advised to ignore this, as the long-term performance of equity markets is generally influenced by structural factors that go beyond political cycles.

Even in purely statistical terms, it has been proven in the past that the outcome of elections in the USA, for example, had no relevant influence on the development of the capital markets. Ultimately, there have been many supposed reasons not to invest every year in the past. Nevertheless, the long-term trend was very positive.

We feel that we are very well equipped for the future, regardless of developments in external factors. Our portfolio companies have promising future growth potential at attractive valuations and have also shown in recent years that they can survive a wide range of crises (COVID, inflation, interest rate rises, etc.) and, as leading companies in their respective sectors, can even turn challenging phases to their advantage. We look to the future with great confidence!

We work hard every day to protect your assets in the best possible way and to increase them in the long term. Both employees and partners of Estably Vermögensverwaltung AG are faithfully invested in our strategy in their private portfolios.

If you have any questions about the annual commentary, please do not hesitate to contact us.

About Estably

Estably is the first digital asset management company from Liechtenstein to offer first-class wealth management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns. The aim is to make professional asset management, which was previously exclusively available to major investors, accessible to everyone – conveniently, transparently and profitably.