Fear of price fluctuations

The unfounded fear of price fluctuations

17. July 2019 | Digital Asset Management

Fear is innate to all people and therefore a constant companion. Originally it served to protect people from danger. True – the threats posed by dangerous animals have diminished today. But new fears, even if they sound absurd, can make people ill, drift them into isolation or render them unable to act.

Why investors are afraid

Fear makes us strive for safety and try to avoid or reduce risks. Risk is an everyday occurrence with which people cope differently. An old proverb says: Fear is not always a good advisor. Especially with the important things like our reputation or the hard and long saved assets. In investment, fear is therefore a constant companion. However, it is important here to recognise the risks, evaluate them correctly and understand them. So what is the risk in capital investment? And how can I reduce this risk?

Most investors see the risk primarily in the price fluctuations of their securities. How can an investor avoid these price fluctuations? There are attempts to reduce fluctuations through the use of products and various strategies. However, these usually do not only cost something, but also have a negative effect on performance in the long term. Price fluctuations on the stock exchange are price changes of the investments. Due to the fact that these price changes are permanently published via many media, they often have a more dramatic effect than they actually are. (We also recommend our article “The Superiority of the stock Investments” on the subject of price changes in investments). So is the risk in the investment really the current price fluctuation or something else?

Price fluctuations on the stock exchange

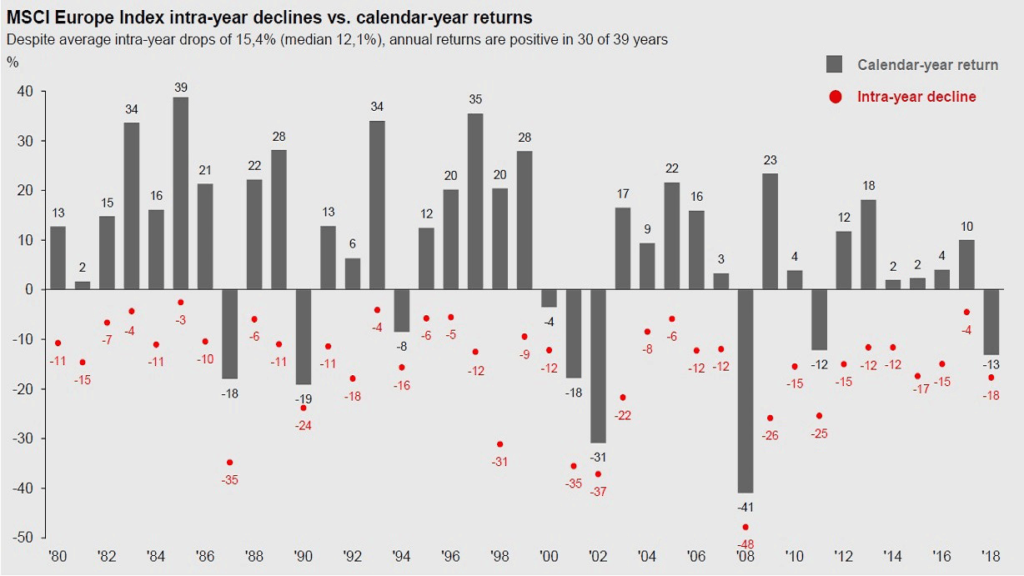

Price declines on the stock market are quite normal and will occur again and again. Factors such as political unrest, economic data and forecasts or speculation usually influence the stock markets and thus the people behind them and their fears. As a rule, these price movements, either upwards or downwards, do not last long and are balanced out over time. The following chart of the MSCI Europe Index shows the interim losses during the year compared to the year-end performance of the respective calendar year. Despite an average decline of 15.4% over the year (median 12.1%), annual returns are positive in 30 out of 39 years. The price losses were therefore only temporary and not permanent.

History of financial crises

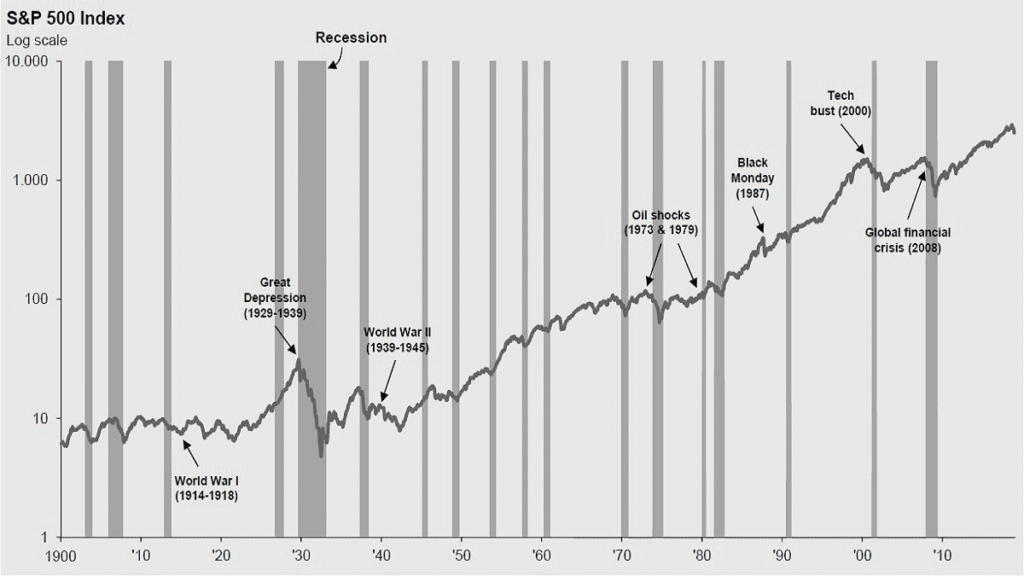

Capital investment and the financial crisis are closely connected. In the past, there have been several events that have led to a global recession and a massive decline in share prices. However, they have always recovered. Even if the slumps led to financial crises. Over a long period of time, share prices (the prices for company units) are again approaching the real value of the company stake. To quote Warren Buffet: “the stock market is a device for transferring money from the impatient to the patient”.

If a company is not too dependent on the economy (and is itself doing well), it earns money regardless of a recession. And the money earned (with good management) benefits shareholders in the form of dividends, share buybacks or an increase in the value of the company.

US real estate crisis (12/2007 – 02/2009)

In order to boost the economy after the bursting of the technology bubble, the US Federal Reserve lowered the key interest rate from 6.5% to 1%. The low level of interest rates led US banks to frivolously grant real estate loans to financially weak borrowers. Many of these mortgage loans were complexly bundled and resold. At the end of 2007, the real estate market began to collapse when it became clear that these complex products were worthless: many homeowners were no longer able to service their debts due to rising interest rates. In the US, 960,000 foreclosures took place in 2009 as real estate prices fell. The high point of the crisis was the collapse of the major bank Lehman Brothers in September 2008, which led to further bankruptcies and an increase in government debt. World equity markets collapsed by more than 40%.

Technology bubble (02/2000 – 03/2003)

At the end of the 1990s, technology stocks were regarded as the big hopes. Investors achieved exorbitant price and subscription profits with companies that were not worth more than a garage. When the speculative wave reached its final peak in March 2000, fundamental valuation ratios hardly played a role any more. As doubts about the earnings promises of technology companies grew and lists of potential bankruptcy candidates were published, prices slumped sharply. The trend was reinforced by the attacks in New York on September 11, 2001. By March 2003, global stock prices had fallen by more than 50%. The technology-based NASDAQ Index even lost more than 80% in value over the same period.

Stock market crash (09/1987 – 01/1988)

On October 19, 1987, the so-called “Black Monday”, the New York Stock Exchange experienced its most severe price decline to date. The leading American index, the Dow Jones, plunged by 22.6% within one day. The wave of sales quickly spread to all major stock exchanges. By the beginning of November, for example, stock market quotations in the USA and Germany had fallen by 32% and 38% respectively. The causes of this stock market crash are still controversial today. It is suspected that high inflation, the dangers of an economic downturn and higher interest rates contributed significantly to the stock market crash. The rapid crash was probably also reinforced by the previous doubling of share prices and the increase in electronic computer trading.

Oil crisis (12/1972 – 12/1974)

The Israeli-Arab Yom Kippur war triggered the first and most serious oil crisis in autumn 1973. The attempt of Egypt and Syria to recapture the Golan Heights and Sinai from Israel failed. OPEC then cut back oil production to dissuade Western countries from supporting Israel. In 1973/1974, the price of oil rose from three to over twelve USD/barrel. In 1975, the German economy shrank by 1.6 percent, and the inflation rate climbed to almost 8%. Equity markets worldwide collapsed by more than 50%. In return, commodity prices rose by more than 80%, the gold price even by almost 120%.

The true risk in the capital investment

From the point of view of a value investor, the true risk in an investment is the risk of a (permanent) loss of capital. Price fluctuation does not mean capital loss, but only that the price of the investment has changed. As long as the actual intrinsic value of the investment does not deteriorate, this is not further bad.

One should therefore not worry about the price movement – these can rather represent a favorable buying opportunity. Only when the company loses market share or customers, new technologies make the company’s products or services useless – basically all events that lead to a significant and sustained decline in the value of the company. So how can the risk of a loss of capital for an investor be avoided or at least reduced?

- The value investor analyses very carefully. The better I know the company in which I want to invest, the lower my risk of permanent capital loss will be. This means constantly investing a lot of time and doing good research to find really attractive companies that are worth investing in. Months of intensive research are done before a qualitative company finally finds its way into the Estably portfolios. We want to understand the business model of the company, its history, the management and its strategic orientation, the industry and the competitors. Only then is it possible to understand the company, its potential and the risks involved in investing in it

- Pay less than you get in value. The concept of value investing also refers to the safety margin. Simply said, it means paying 50 cents for something that is worth 1 EUR.

Source specification:

Guide to the Markets Quarterly JP. Morgan Asset Management, MSCI, Thomson Reuters Datastream, J.P Morgan Asset Management as of December 2018

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might still like these posts

Finance Blog

The snow falls quietly, the markets crash loudly?

Is there still a year-end rally? Why we don’t care about this question, and why you shouldn’t care about it either, can be read in our little Christmas article:

Market commentary: Uncertainties lead to short-term price drops

Macroeconomic and geopolitical issues are resulting in uncertainties and leading to higher volatility on the capital markets.

We will not be infected! How the coronavirus influences our strategy

Due to current events, we would like to share our thoughts, strategies and tips in connection with our investments and the coronavirus.