The superiority of the stock investment

December 20, 2018 | Digital Asset Management

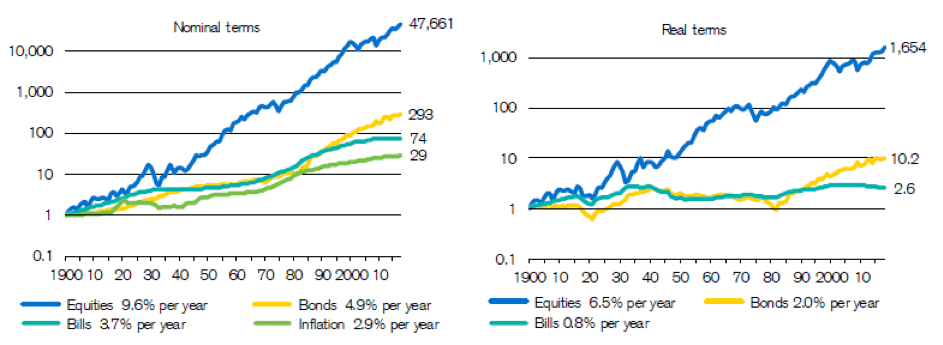

In the long run, returns on equities outperform the returns on all forms of investment such as bonds, cash, precious metals, or even real estate by far.

The real performance of the investments

Why the yield on real estate decreases

The risks of real estate investments

What you can still learn from a real estate investor

Shares vs. precious metals

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might still like these posts

Finance Blog

The Right Mindset for the Next Crash

We don’t know when the next crash will come. Nobody does. What we do know is that a crash will happen again at some point.

We’re not pessimistic, just realistic. It’s a proven fact: Since 1950, the S&P 500 has seen double-digit declines on average almost every two years.

Half-year commentary 2023: From crisis to recovery

After a very turbulent 2022, the first half of 2023 saw a stabilisation in the capital markets, with strong recoveries in certain sectors.

What makes the rich get richer and richer

Half of the world’s wealth is held by millionaires, most of them are located in the US, followed by China, Japan, the UK and Switzerland.