Good is not good enough for us - we want more than the MSCI World return

March 29, 2019 | Digital Asset Management

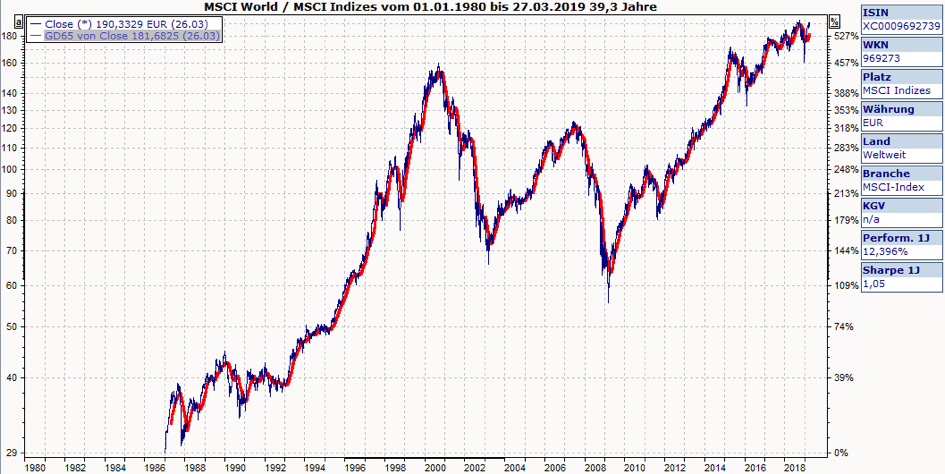

MSCI World return over the last 40 years

Patience is a virtue that most people lack. But patience is one of the keys to success, especially in value investing. Because let’s be honest: wouldn’t you lose faith in success if, after five years of negative performance, you were still being told that things would get better?

But: If you had invested EUR 100,000 in the MSCI World Index (in EUR) 40 years ago, you would have an amount of over EUR 2.5 million in your account today (in purely nominal terms, without inflation).

You often hear the argument that you don’t need an asset manager because some indices are better than asset managers anyway and you should therefore buy index funds yourself at low fees. But don’t be fooled.

What if you had entered the MSCI World Index 20 years ago instead of 40 years ago? The average annual return would then be around 2%. That’s less than inflation. The “under-the-mattress” investment method would have been the better choice. Isn’t that absurd?

We want more than the MSCI World return

- If you stick with it long enough, you win. Because those who remain calm even after the long, almost painful period of negative performance are rewarded with positive annual returns in the end.

- An index usually performs well on average over the long term. But good is not good enough for us. We pick out the pearls from the index and only invest in those companies that we consider to be particularly attractive. We filter out the bad, average or overpriced companies and invest specifically in the strong, cheap or fairly valued companies. This guarantees an excess return. However, this requires a lot of experience, skill and patience to find the pearls.

Our conclusion: Exercise patience, it will be worth it! Take a look at Estably’s performance comparison with other competitors.

Estably is the first Liechtenstein-based digital asset management firm to offer world-class asset management through a blend of technology and human investment expertise. Thanks to the portfolio managers’ many years of experience in the field of value investing, the aim is to achieve above-average returns – starting at an investment sum of € 20,000. The aim is to make professional asset management, which was previously possible exclusively for major investors, accessible to everyone – in a convenient, transparent and profitable way.

You might still like these posts

Finance Blog

NEW: Your custody account outside the EU – with Estably and the Liechtensteinische Landesbank

You can now manage your Estably securities account not only with the German Baader Bank, but also with the traditional Liechtensteinische Landesbank (LLB). A custodian bank outside the EU in one of the most renowned financial centers in the world offers unique advantages.

The EU Europe of Insolvency (guest article by Markus Miller)

In this guest article, author and economic expert Markus Miller warns of impending insolvency and calls on investors to act responsibly and rationally.

LIGHT Foundation: The multi-generation model for your capital protection (guest article by Markus Miller)

Insurance policies from the Principality of Liechtenstein offer you foundation-like advantages and are already ideally suited for professional structuring models for contract sums from €50,000.