Commentary on Performance 2022

Why did portfolios perform weaker in 2022 than in previous years?

Anyone who has followed our performance since the beginning will have noticed that the fluctuations are higher than with other robo-advisors. The main reason for this is a different investment approach, which, in combination with the current uncertainty in the markets, makes for higher volatility.

In this commentary, you will learn why our portfolios are subject to greater fluctuations and what opportunities are available to long-term investors.

High concentration means higher fluctuations

Compared to other Robo-advisors who invest in hundreds of companies via ETFs, our investment approach is much more concentrated. Our portfolios contain only between 20 and 25 individual stocks and are subject to correspondingly higher fluctuations.

In good stock market years, this approach enables us to achieve far higher returns than an index. In weaker stock market years, on the other hand, we may underperform. However, since good years are far more common than bad ones, this concentrated approach has enabled us to outperform benchmarks over a longer period of time.

For investors with a long investment horizon, however, our philosophy offers more opportunity than any other to benefit from above-average returns.

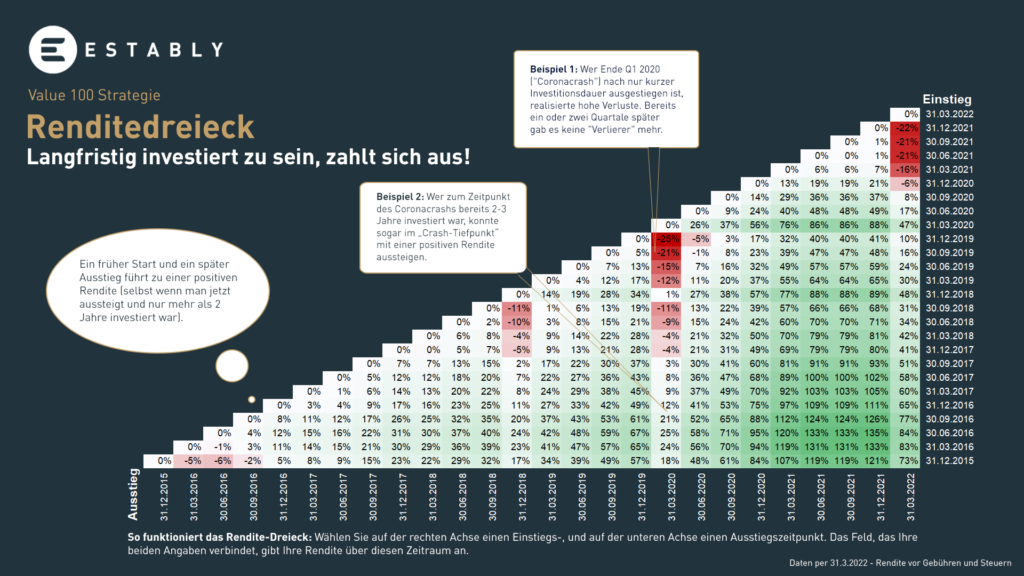

A look at our return triangle shows not only that positive quarters (green) outweigh negative quarters (red), but also that performance becomes positive with longer investment horizons.

Strong companies in fear-driven markets

Our strategy is to invest our clients in outstanding companies that have the potential to generate above-average returns in the long term.

We monitor potential investments for months, analyse key figures and balance sheets, talk to customers, suppliers and ex-employees, examine the competitive environment, scrutinise management and look for unique competitive advantages.

Only when a company convinces us in every respect, and is furthermore still trading below its long-term actual value, do we invest.

We remain convinced of the long-term earnings power of all the companies currently in our portfolios. We receive confirmation of this almost every quarter when the companies publish their quarterly reports.

But why are these excellent results not (yet) reflected in the share prices? Modern value or quality investing as practised by Estably is based on a long investment horizon.

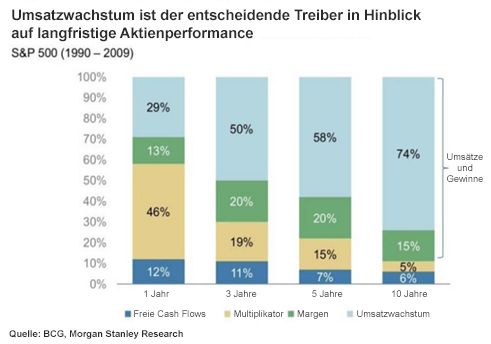

The value of a share results from all future free cash flows of a company, discounted to today, divided by the number of shares. However, the value and price of a company or share diverge to a greater or lesser extent over time. However, the long-term drivers of a share price will always be a company’s sales growth, earning power (margin), and ability to allocate capital.

In the short term, however, it is primarily the expectations of market participants, which are reflected in valuations, that determine the share price.

Market participants were guided by pessimism, fear and uncertainty last year. They sold out of fear of rising interest rates, without regard for the medium- to the long-term profitability of companies, causing valuations to adjust downwards.

Warren Buffet put it aptly:

"The stock market is a system that transfers money from the impatient to the patient."

Warren Buffett

In times of crisis, the focus of the capital market is on the “here and now”. The investment horizon is immediately shortened drastically and obvious risks are avoided.

In a simultaneously highly inflationary market environment and in anticipation of rising interest rates, there are currently very clear losers on the capital market – consumer-oriented technology companies in strongly growing markets that reinvest all profits in future growth.

The valuation of such companies depends purely on expected long-term sales and margins, about which only assumptions can be made at present, and is thus particularly subject to the imagination of investors in the short to medium term.

In the environment of the past year, with lower growth after the pandemic and increasing cost pressure due to inflation, a very pessimistic picture was painted. This was also reflected in the media coverage. Whereas in rising stock market phases an overly optimistic picture is sometimes painted and negative topics are generously overlooked, last year it was the other way round. The hair in the soup was literally sought.

Unpredictable development of the Russian market

At the beginning of March 2022, we were in an ongoing exchange with the management of the Russian companies in our portfolios but did not expect such an escalation of the conflict and the associated suspension of stock market trading.

In addition to the already mentioned price declines caused by the strongly negative market movement due to rising interest rates, this unforeseeable development “cost” is approx. 4-6% performance in the portfolios.

Attractive entry opportunity thanks to favorable valuation

We remain firmly convinced of our strategy and our companies. For investors with an investment horizon of several years, there is a favourable entry opportunity that can lead to a special outperformance in the coming years.

We are convinced that we will be able to realise an attractive and above-average increase in value over the years – as in the years before.

For more detailed information on our strategies, please do not hesitate to contact us.

These articles may also interest you: