Modern Value Strategy

Investments in

Top companies

Wir investieren Ihr Vermögen nach modernen Value Investing Prinzipien in sorgfältig selektierte Einzelaktien von erstklassigen Unternehmen.

Modern Value Strategy

Growing with outstanding companies

We invest your assets according to modern value investing principles in carefully selected individual shares of first-class companies. Corporate bonds from our in-house fund complement your portfolio efficiently.

- Investment in handpicked individual shares

- Bond funds for efficient admixture

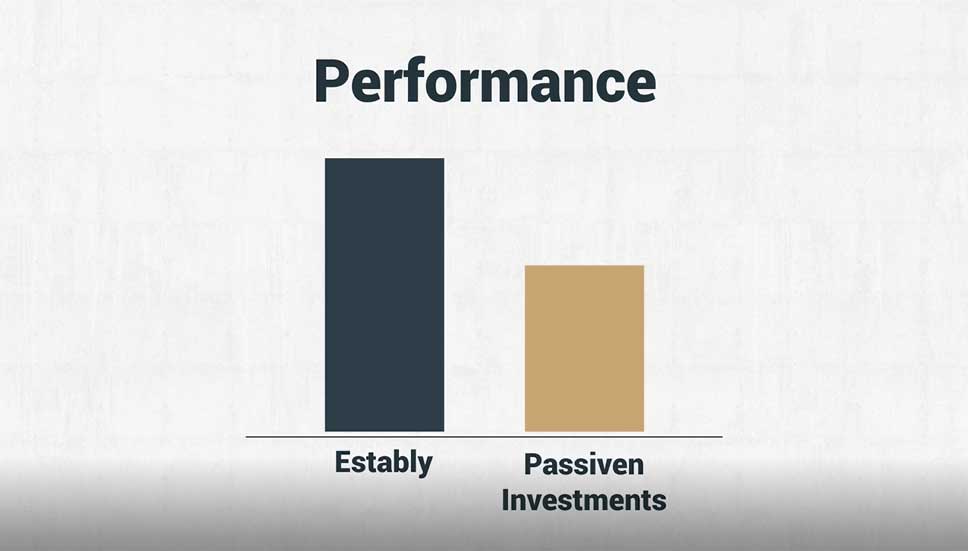

- Strongest performing Robo advisor strategy 2023

Hand-picked individual shares

Your assets grow with first-class companies

In our Modern Value Strategy, we invest you in 20-25 shares of high-quality companies.

Before we decide on a share, a company has to convince us on a whole level. In addition to balance sheets and key figures, we are particularly interested in soft factors that cannot be measured by numbers. These include, for example, the quality of the business model, the management or unique competitive advantages.

Risk diversification

Efficient admixture of bonds

To spread the risk in your portfolio, we use our in-house “Fructus Value Capital” bond fund in addition to individual shares. The exact bond share depends on your risk preference, which you determine during registration.

The fund contains a selection of attractive corporate bonds, which we select with a similar care as our individual shares.

Risk management

Safety margin concept

The “margin of safety” concept in our value investing strategy ensures that each share in your portfolio has a sufficient safety cushion.

This cushion is created by the difference between the share price and the actual value of the company. The more undervalued a company is according to our analyses, the more likely it is to weaken (for example in times of crisis) in order to still be profitable.

We also pay particular attention to the crisis resistance of companies. We prefer to invest in companies that have already survived crises unscathed in the past or have sufficient liquidity to master a future one.

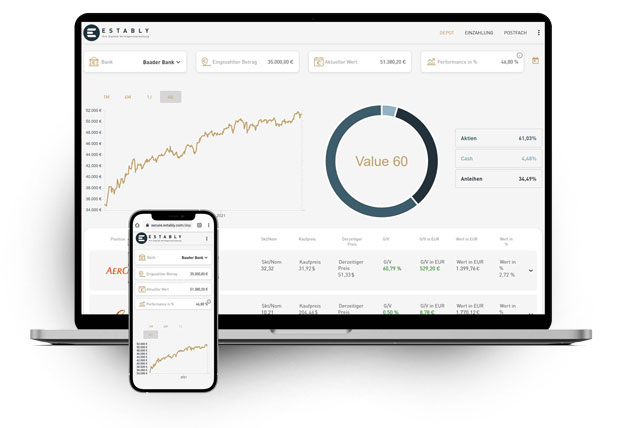

You determine your growth opportunities

Within the Modern Value strategy, you can choose from five portfolios, which differ in their respective share and bond proportions. A higher share of equities generally means more long-term growth potential with higher fluctuations in value.

Conservativ

Modern

Value 20

Long-term preservation of real assets with small fluctuations

Defensive

Modern

Value 40

Long-term asset growth with moderate fluctuations

Balanced

Modern

Value 60

Greater growth in the long term with medium fluctuations

Dynamic

Modern

Value 80

Significant long-term growth with major fluctuations

Offensive

Modern

Value 100

Strong long-term growth with major fluctuations

Can’t make up your mind?

In our application process, we suggest a suitable portfolio based on your knowledge and risk appetite.

Return

Performance of the Modern Value Portfolios since inception

Our fees: Transparent & fair

The costs for the Modern Value Strategy consist of an all-in fee and a performance fee. However, this is only incurred if we have been able to achieve a new performance high in your custody account.

Your costs depend on the custodian bank you choose:

About Baader Bank

The German Baader Bank has state-of-the-art technological infrastructure and is one of the leading investment banks in Germany. For clients domiciled in Germany, Baader Bank automatically remits taxable income.

- From €20,000 minimum investment amount

- For customers resident in Germany:

- Automatic transfer of tax revenues

- Loss offsetting pot

Costs

1,20% All-In Fee

- Includes:

- Custody fees

- Bank charges

- Service fees

- Transaction costs

About the LLB

About the LLB

Founded in 1861, LLB is the most traditional financial institution in the Principality of Liechtenstein. Like most Liechtenstein banks, LLB is very concerned to have sufficient high-quality equity capital.

- From 50.000€ Minimum investment amount

- Advantages of Liechtenstein as a financial centre (learn more)

- Traditional financial institution since 1861

Costs

1,50% All-In Fee

- Includes:

- Custody fees

- Bank charges

- Service fees

- Transaction costs

Awards

Invest in the winner of the real money performance tests

biallo.de

Performance winner 2023

geldanlage-digital.de

Performance winner 12 months (02/2024)

brokervergleich.de

Performance winner 2023

brokervergleich.de

Best risk-return ratio 2023

Do you want to invest sustainably in individual shares?

- High MSCI-ESG Score

- Modern Value Investing

- 5 Individual risk preferences

At a glance

Modern Value Strategy

- Investments according to modern value investing principles

- Participations in outstanding companies

- Units in the Fructus Value Capital bond fund

- Own securities account at Baader Bank or Liechtensteinische Landesbank

- Access to your personal dashboard

- Regular information in the form of summarised quarterly reports and company updates

- Also available as ESG-compliant Value Green Strategy

Our strategies

Individual shares

Our “Modern Value” strategy is based on hand-picked individual stocks selected according to modern value investing principles.

Funds

The “Best of Funds” strategy allows you to invest in the funds of the most successful value and quality investors.

Gold

This strategy focuses on the protection of your assets. To this end, we invest in gold, supplemented by stable currencies.