What type of investor are you?

Do you accept short-term fluctuations to make your portfolio grow faster and bigger, or do you prefer a slower but steady growth of your assets?

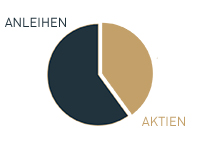

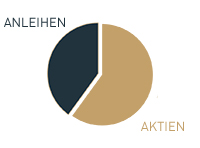

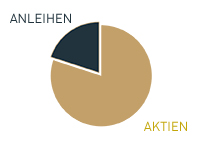

We offer the right strategy for every type of investor. The decisive factor is the equity ratio: more equities mean more potential return, but also increased fluctuations on the long-term appreciation of the portfolio.

Can’t make up your mind?

During the registration process, we will suggest the optimal strategy based on your information!

Market Commentary

Market commentary: Winners of the pandemic are correcting

In the last two years (since April 2020), the stock markets have almost exclusively risen. There have been no notable setbacks, and the U.S. market in particular.

3. February 2022

Tips

Speculators lose, long-term investors win

It’s no secret – those who invest in shares over a sufficiently long period of time achieve not only exclusively positive, but better returns than with bonds, precious metals, time deposits & Co.

8. March 2022

Tips

Is now the right time to invest?

Catch the perfect moment and beat the market – the supposed dream of every investor. In practice, however, this rarely succeeds, because: nobody can look into the future and predict when exactly the markets will rise or fall again.

10. June 2020