Digital & uncomplicated

High-performance provisioning & making dreams come true

With Estably’s digital pension plan, you can provide for your future in an uncomplicated and high-performance way.

- Higher returns thanks to tax benefits

- Location advantages at Liechtenstein as a sought-after financial centre

- Optimised for Customers from Germany

The smart way to prosperity

Even a small monthly amount can create a large fortune – thanks to our long-term high-performance investment strategy and considerable tax advantages.

Unique tax advantages

Thanks to special taxation rules in the context of old-age provision, you are left with more of your profit.

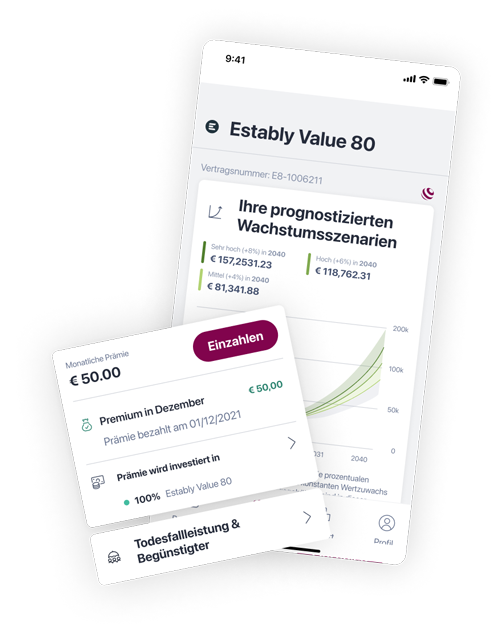

100% digital & uncomplicated

With our app, you can make additional payments, receive documents digitally and securely, and keep an eye on performance.

Investment in top equities

Your deposits are invested in shares of excellent companies that are traded below their value on the stock exchange.

Advantages at the Liechtenstein location

The Principality of Liechtenstein offers investors decisive advantages over Germany.

Transparent & fare costs

You benefit from low costs, which we always communicate transparently.

Policy check

You already have an existing pension plan? We offer you a free analysis!

Provide with the real money test winner

Our goal is to achieve above-average returns over the long term. The results of the real-money performance tests, in which independent testers invest their own assets in the providers, show that we succeed in this.

biallo.de

Performance winner 2023

geldanlage-digital.de

Performance winner 12 months (02/2024)

brokervergleich.de

Performance winner 2023

brokervergleich.de

Best risk-return ratio 2023

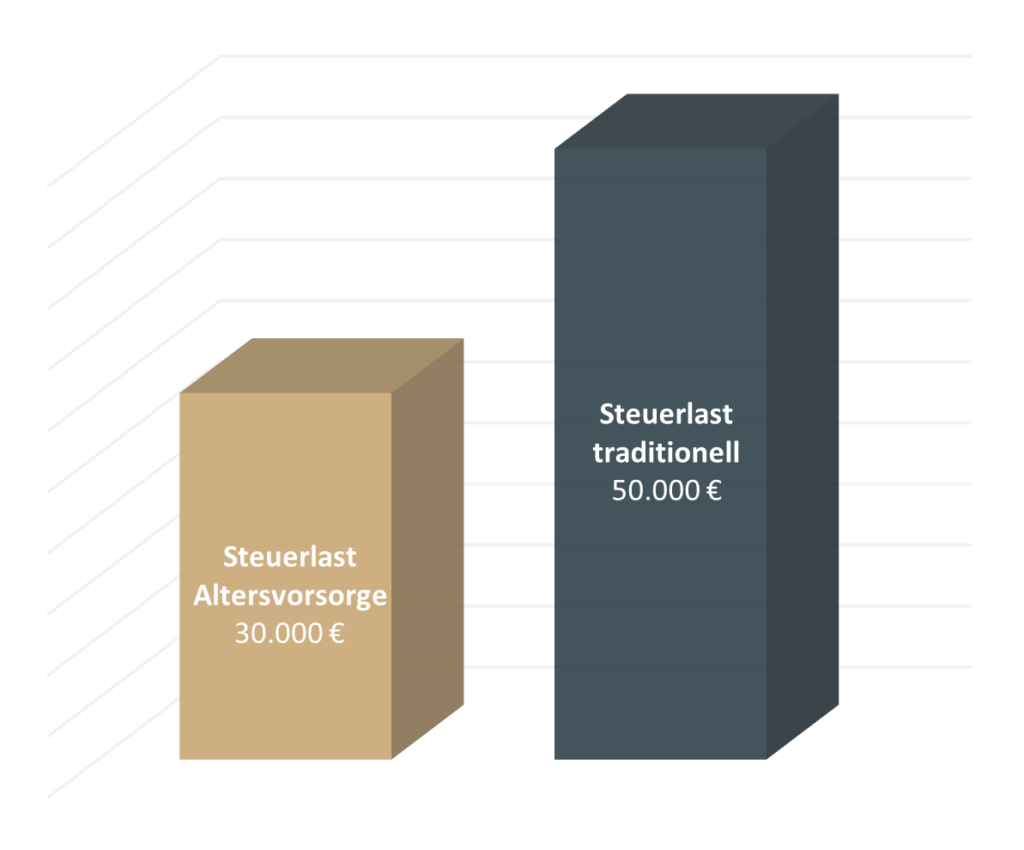

More profit thanks to tax optimisation

With the Performance Tool you can find out how much wealth you can build up and how much tax you can save!

Your tax advantages with a pension plan:

Tax-free savings phase

During the savings phase, you do not pay any taxes on the profits of your investments. Your savings amount is therefore larger and you benefit even more from the interesting effect in the end!

Only half of the profit taxed

If your pension plan has been active for at least 12 years and you have reached the age of 62, only half of your gain is taxed.

Example: Tax saving

With a personal tax rate of 30%, you effectively pay only 15% tax on the gains (instead of 25% capital gains tax). With an increase in value of €200,000, this amounts to a saving of €20,000.

Decisive advantages in Liechtenstein as a financial centre

The Principality of Liechtenstein not only boasts a stable political and legal framework, but also has an important advantage over insurance in Germany.

No prohibition of payment

If an insurance company gets into difficulties in Germany, a "payment ban" can be imposed by law. The insurance company must then temporarily stop making payments. This law does not exist in Liechtenstein.

Triple-A rating without sovereign debt

Liechtenstein is one of the few debt-free states in the world. Thanks to a combination of direct democracy and constitutional hereditary monarchy, Liechtenstein also enjoys an extraordinarily solid social, legal and economic order.

Building wealth with high-growth equities

We invest your saved assets in shares of first-class companies according to modern value investing principles.

Long-term performance

The longer you hold shares, the higher the chances of achieving above-average returns.

Chance of high compound interest effect

Due to the long-term investment period, your assets can grow strongly through the compound interest effect.

Risk diversification through bonds

A mixed bond component (max. 20%) provides more diversification in the portfolio.

Warren Buffett, Value Investor

Let your wealth grow exponentially

The earlier you start saving, the more you benefit from the compound interest effect.

Here you can see an example of the performance of a pension insurance policy. In this example, the insured person is 40 years old and invests €100 per month for 27 years.

Development of assets for a monthly deposit of €100 with an assumed net performance of 8%.

Our costs: transparent & fair

Complete transparency is important to us. This table tells you everything you need to know about our fees:

Estably as a retirement provision

Minimum investment amount:

From €50 per month

All-In Fee:

Dependent on monthly deposits:

Under 100€: 2,10%

Over 100€: 1,50%

From deposits totaling €10,000, the All-In fee is a constant 1.50%.

Fixed fee:

For less than 10.000€ invested premiums: 5€ per month.

Note: This amount is invested and paid out again at the end of the term (= loyalty bonus).

Loyalty bonus:

At the end of the term

Performance Fee:

10%¹

Taxation on payout:

Income tax on half of the income²

Death benefit:

110% of the fixed assets³

Entry/termination fees:

Keine

Life annuity option:

Yes

¹ The performance fee of 10% only applies if Estably reaches a new performance peak in the respective year. If Estably does not achieve this, any decline must be recovered in the following year before this fee is incurred. Details

² For this so-called half-income procedure to apply, you must remain invested for at least 12 years and until you reach the age of 62. Before that, capital gains tax applies.

³ The death benefit decreases from 110% of the investment assets to 100% of the investment assets on a straight-line basis until the start of annuitisation. An individual premium is calculated for this. For a healthy 30-year-old, experience shows that this is less than €1 per year.

Our costs: transparent & fair

Complete transparency is important to us. Find out everything you need to know about our fees here:

Estably as a retirement provision

Minimum investment amount

From €50 per month

All-In Fee

under 100€ monthly savings: 2.10% p.a.

over 100€ monthly savings: 1.50% p.a.

Fixed fee

For less than 10.000€ invested bonus: 5€ monthly.

Note: This amount will be invested and paid out to you again at the end of the term (= loyalty bonus).

Loyalty bonus

At the end of the term

Performance Fee

10%¹

Tax advantages with the payout

Income tax only on half of the income²

Death benefit

110% of fixed assets³

Entry/termination fees

100€ in case of early termination

Life annuity option

Ja

¹ The performance fee of 10% only applies if Estably reaches a new performance peak in the respective year. If Estably does not achieve this, any decline must be recovered in the following year before this fee is incurred. Details

² For this so-called half-income procedure to apply, you must remain invested for at least 12 years and until you reach the age of 62. Before that, capital gains tax applies.

³ The death benefit decreases from 110% of the investment assets to 100% of the investment assets on a straight-line basis until the start of annuitisation. An individual premium is calculated for this. For a healthy 30-year-old, experience shows that this is less than €1 per year.

More profit thanks to tax benefits

Within old-age provision, tax advantages make your investment even more attractive:

Tax-free savings phase

During the savings phase, you pay no tax on the profits of your investments. Your savings amount therefore increases and you benefit even more from the compound interest effect!

Half profit tax free

If your pension plan has been active for at least 12 years and you have reached the age of 62, only half of your gain is taxed.

Example: With a personal tax rate of 30%, the gains effectively attract 15% tax instead of 25% capital gains tax. With an increase in value of 200,000€, this amounts to a saving of 20,000€.

We will be happy to provide you with more details about your tax benefits in a personal meeting.

FAQs

Frequently asked questions

Digital & uncomplicated to prosperity in old age

This is how private pension provision works:

1. Start the onboarding process

Hier to start the registration process, which will take you step by step to your goal.

2. Monthly deposits

during the term

We offer you flexible deposit options. An initial investment is also possible in addition to the monthly deposits.

3. Tax-optimised assets

to be paid out

At the end of the term (after at least 12 years and from the age of 62), you can have your assets paid out flexibly.

Do you already have an existing retirement plan?

Our experts offer you a free analysis so that you can compare your current policy with the pension solution from Estably and prosperity solutions!

Your first step towards financial independence

You can conclude your old-age provision uncomplicatedly and completely digitally in just a few minutes. If you still have questions, we will be happy to answer them in a non-binding consultation.

(Note: no costs are incurred at the time of registration)

One step closer to prosperity

In a non-binding discussion, we will inform you about how you can make tax-optimized provisions for your prosperity.

Do you have no further questions? Here you go directly!

The insurance policy is arranged by prosperity solutions AG, an insurance agent of the Liechtenstein Life Assurance AG

The Prosperity solutions AG acts as an insurance agent in accordance with the Insurance Distribution Act of 5 December 2017 (VersVertG, LGBl. 2018 No. 9).

This insurance policy is brokered by prosperity solutions AG, An insurance agent of the Liechtenstein Life Assurance AG

The prosperity solutions AG operates as an insurance agent within the meaning of the Insurance Distribution Act of 5 December 2017 (VersVertG, LGBl. 2018 No. 9).